Exploring Supply Chain Industry – 2022 vs 2023 Predictions

Table of Contents

Supply Chain Market Update – Outlook 2022 Vs Prediction 2023

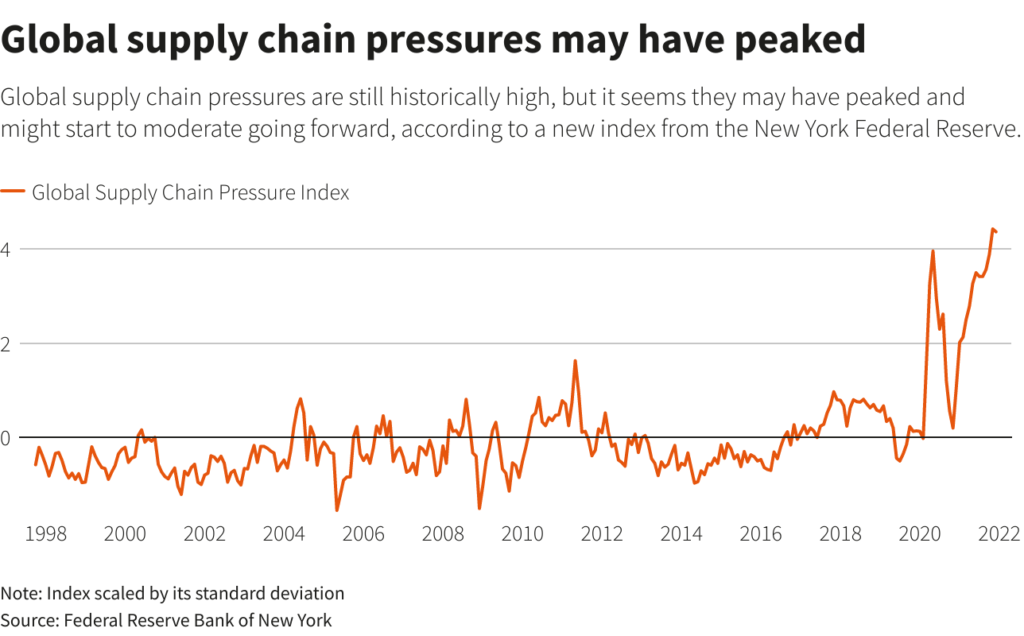

In 2022, the supply chain industry faced both highs and lows. Unfavorable weather conditions, geopolitical instabilities, and labor disputes caused disruption in the flow of goods. The Russian-Ukraine conflict caused a shortage of certain products and an increase in their prices. Additionally, China’s stringent lockdown rules inflicted further disruption in the supply chain. To make matters worse, strikes around the world led to delays in transportation.

In 2022, experts noted a significant amount of congestion on USWC and USEC, leading to concerns that there would be no relief for the supply chain industry. However, they were hoping to see an easing of the congestion in that year. Unfortunately, due to geopolitical tensions and inflation in 2023, it is unlikely that the supply chain industry will receive any relief in the near future.

This overview provides a look at the conditions of ocean, sea, and trade in 2022, as well as predictions for the upcoming year.

Ocean Freight – Outlook 2022 vs Predictions 2023

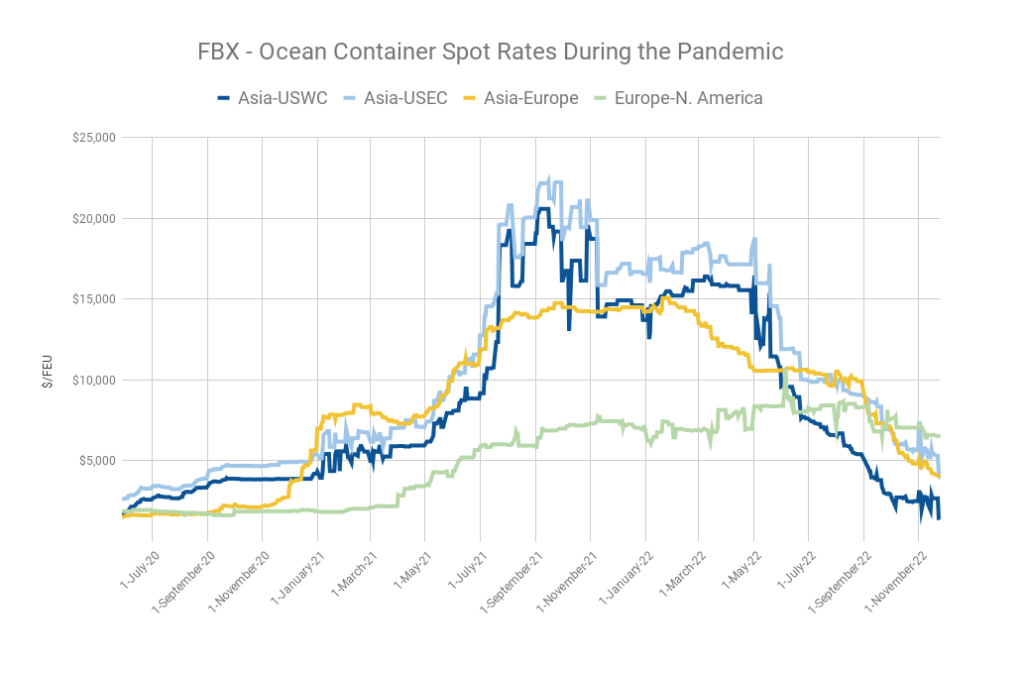

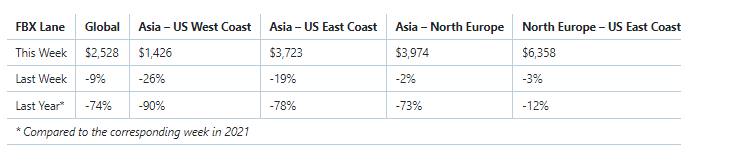

In Spring 2022, the cost of ocean freight began to decrease, with China to USWC rates approaching pre-pandemic levels. According to a study conducted by Freightos, the rate for 40-ft containers for the Asia-USWC trade lane decreased by 80% of its previous price in April 2022. Additionally, prices on the East Coast were reduced by two-thirds.

Freights data shows that freight rates in November 2022 dropped by 21% and ended up at $2,607/FEU, which is 70% lower than in 2021. This was because of weak demand and high congestion levels. Spot rates for all Asian lanes also decreased, despite all the blank sailings.

By the end of 2022, congestion levels in Long Beach and LA ports, and New York returned to normal, but Southeast and Houston ports still had some congestion.

The West Coast congestion got better because there was a big decrease in USWC volumes, since shippers switched to using East Coast and Gulf ports. This was due to unresolved issues and a labor dispute on the US West Coast.

The rates for transpacific shipping went down on all coasts.

- The rate from Asia to North America on the West Coast dropped 42% to $1,424 per FEU

- On the East Coast it dropped 31% to $3,874 per FEU

- For Asia-Europe, both the rate and number of shipments decreased, with the rate going down 16% to $4,072 per FEU.

After the past couple of years of overcapacity and rising freight rates, ocean freight is in for a bumpy and difficult time in 2023. Ideally, the amount of cargo shipped will stay the same as 2022, but for most routes, it’s likely to go down. The volume could go down by 2.5%, or even more, depending on the global economic situation. This decrease in cargo also means that shippers won’t be able to negotiate with carriers.

This year, demand is predicted to go down, which should help reduce the amount of congestion at ports. Right now, congestion is at 8%, but it could be cut in half to 4% if things go well in the US West Coast, US East Coast, and Northern Europe.

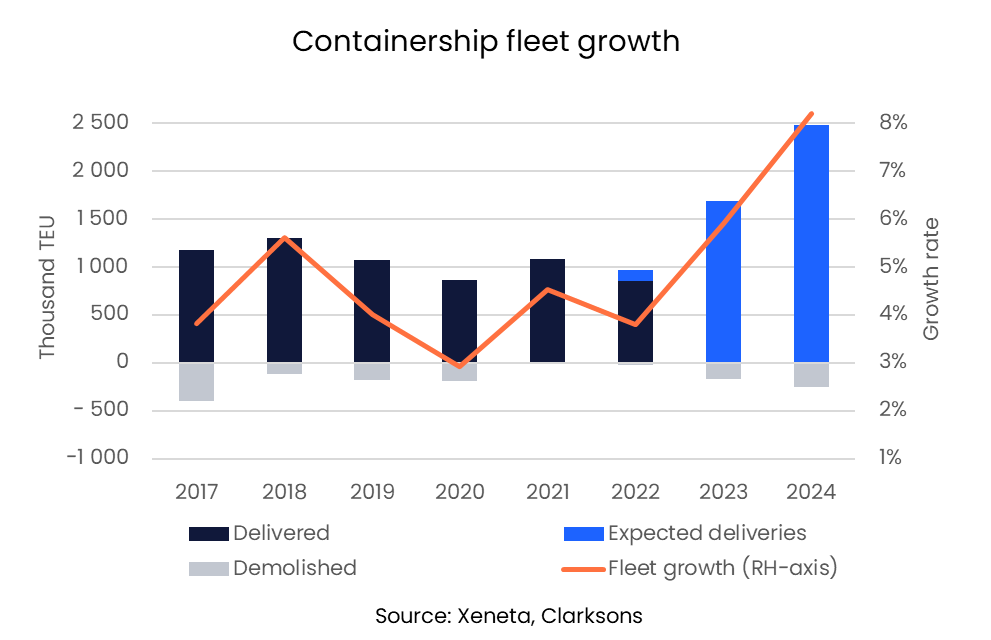

Based on several predictions, the idling of ships will start increasing as we move on with the year 2023. About 1.65 million TEU will come in, but some ships will be demolished too, so the fleet growth will only be 5.9%. This means we could be facing overcapacity again.

Air Freight – Outlook 2022 vs Predictions 2023

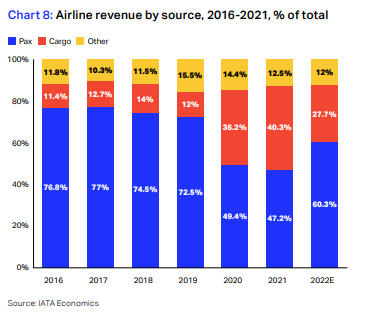

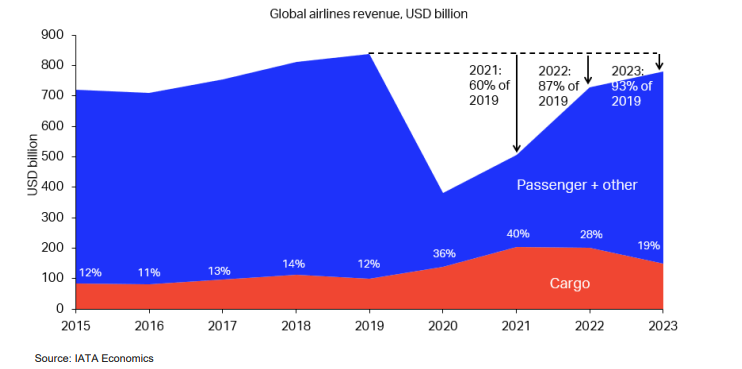

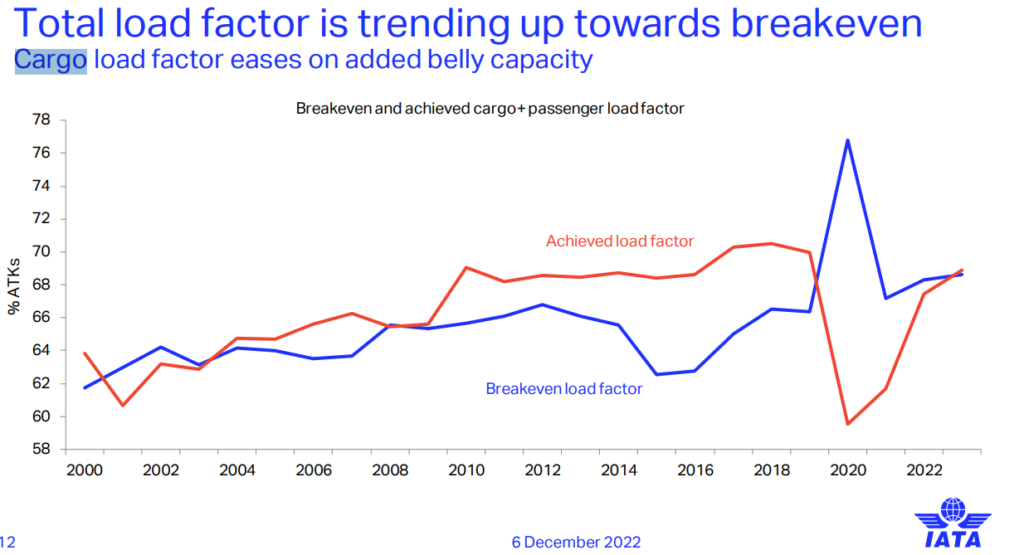

Since the pandemic started, there has been a huge increase in demand for air cargo, especially for delivering vaccines quickly. With fewer passenger flights, cargo has become the main source of income for airlines. In 2021, cargo has made up 40% of the airlines’ revenue, which is a huge jump from before. This is mainly because of the decrease in passenger flights and the increase in cargo volumes.

Trade Conditions – Outlook 2022 vs Predictions 2023

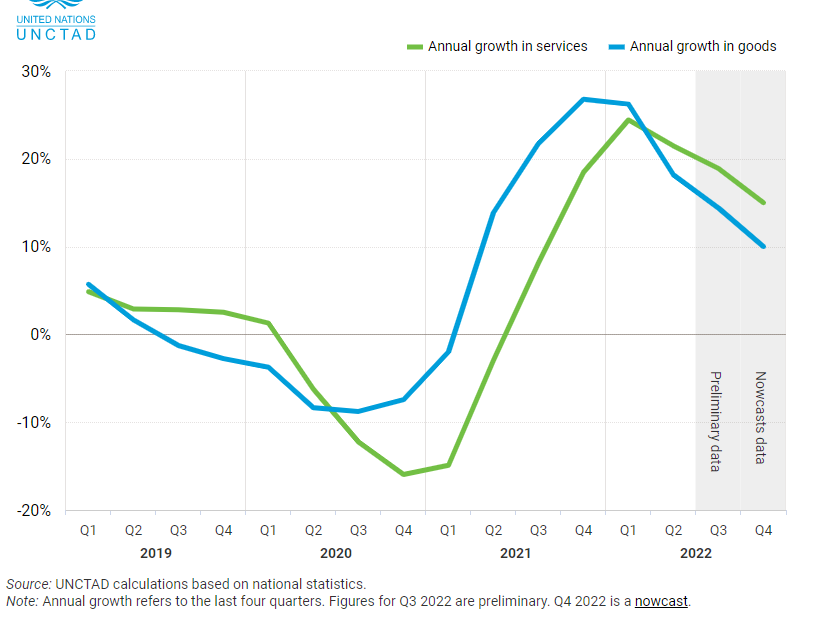

In 2022, global trade hit an all-time high of $32 trillion, but it started to drop in the second half of the year and is projected to decrease even more in 2023. According to the Global Trade Update Report from UNCTAD, the trade slump could worsen next year because of geopolitical issues and tight finances.

Even with the Ukraine-Russian war going on, trade of goods and services stayed strong in 2022. The trade of goods went up 10% from the previous year, and it was around $25 trillion. Services trade increased 15%, and that was around $7 trillion.

Though UNCTAD says that in the late 2022 there’ll be a slowdown, 2023 will still be a tough year with inflation, energy and interest rate hikes, plus the bad effects of the Ukraine-Russian war still lingering.

Many companies have started to take action to minimize the effects of these issues, and the Middle East is ready to make changes to ensure the global crisis has minimal impact on the supply chain. As we move into 2023, here are some of the changes that shippers and carriers are making:

Local News

Mirsal has announced some new improvements as of January 1st, 2022

According to notice 5/2022, courier companies will have access to some great features like a

- Lower minimum threshold for declaring low-cost items

- Cheaper fees for customs services

- Duty exemptions for carrier declarations

UAE GCAA Dangerous Goods Certified Entities List Generated (H3)

Everyone on the list will get their dangerous goods certificates online instead of in person now that working conditions are different because of the pandemic.

Shipping Handling Process Will Become Much Easier From 16th January 2023

Hapag Lloyd have made it easy to sort out your shipping. You can now get your Bill of Lading draft amendments online in just 2 hours after you ask for it on their website.

Global Interesting News

Freight News

Air

Etihad Cargo to benefit from increased US belly capacity. Read more

JD Logistics Airlines builds cargo routes in China. Read more

IAG Cargo dismisses near future freighter investments. Read more

EV Cargo publishes inaugural sustainability report. Read more

Amazon Air is set to sell space on its aircraft to third parties. Read more

Nippon Cargo Airlines to use Neste MY Sustainable Aviation Fuel for their cargo flights reducing the emissions of cargo transport. Read more

MSC Group completes acquisition of Bolloré Africa Logistics. Read more

GoPlasticPallets invests in site expansion to support 2023 growth strategy. Read more

Kuehne+Nagel to double French airfreight business. Read more

DB Schenker to develop new airfreight facility at Oslo Airport as imports continue to grow. Read more

Air cargo demand drops further as holiday season starts: WorldACD. Read more

Ocean

Maersk Completes Acquisition of Logistics Firm Martin Bencher. Read more

FMC examines shipping line compliance on anti-retaliation. Read more

Indonesian port operator takes measures for potential extreme weather. Read more

CN analysis: Box carriers’ rate struggle on India trades continues amid demand challenges. Read more

Transpacific ocean rates return to 2019 levels. Read more

European recession dragging down ocean freight demand, rates. Read more

Outgoing ministers sign off on Haifa port privatisation. Read more

Ground

Rail regulators streamline process for shippers to challenge unreasonable rates. Read more

Other

C.H. Robinson announces major executive leadership change, with Biesterfeld stepping down. Read more

Crude tanker rates down double digits after Russia sanctions debut. Read more

MODE Global Announces Corporate Partnership with United Way of Metropolitan Dallas. Read more

AD Ports sets sights on Caspian region with Kazakh offshore and shipping tie-up. Read more

3PL News

The Future of Warehouse Automation: What to Expect in 2023. Read more

Warehouse receipt fraud: Singapore firm can’t trim US$282mn damages ruling. Read more

Maersk to build first green and smart flagship logistics centre in Lin-gang, Shanghai. Read more

Hydrogen Storage and Distribution Are About To Become A Huge Market | Hexagon Composites, NPROXX, Faurecia, CLD. Read more

A.P. Moller – Maersk announces new and innovative cold storage facility in Norway. Read more

Acme records 30% growth in 2022. Read more

Trade and Customs News

Gebruder Weiss prepares for Turkey’s growing appeal to European importers and exporters. Read more

TDB agrees to a US$100mn trade finance facility with Export Trading Group. Read more

Ecommerce Logistics News

Wincanton to provide e-commerce logistics to Huda Beauty in UK. Read more

Yango Delivery launches in the UAE to empower e-commerce sector with one-stop shop logistics solution. Read more

Amazon to cash in on China’s eCommerce. Read more