Supply Chain and Logistics Updates – November 2023

Table of Contents

Expanding the European Union Emission Trading System (ETS) to the Shipping Sector: Ramifications and Timeline

Commencing on January 1, 2024, the European Union is set to extend its Emission Trading System (ETS) to encompass the shipping sector, specifically targeting large vessels with a gross tonnage exceeding 5000. This initiative establishes a stringent limit on the cumulative greenhouse gas (GHG) emissions permissible from installations, aircraft, and vessel operators operating within the European Union (EU) on an annual basis. To adhere to this framework, companies must secure emission allowances corresponding to their GHG output, obtainable either through the EU carbon market or via trade with other enterprises. Failure to meet these emission allowances will result in significant financial penalties.

Year by year, the emission cap will be progressively reduced in line with the EU’s climate objectives. The ETS application in the shipping sector will encompass all GHG emissions from intra-European voyages and 50% of voyages commencing or concluding in Europe, with a staged implementation ultimately achieving complete coverage by 2026. This transformation will translate into a gradual uptick in surcharges, with projected industry-wide cost implications estimated to range between USD 9-10 billion.

Ocean Freight Insights for November 2023

| Key | |

| ++ | Strong Increase |

| + | Moderate Increase |

| = | No Change |

| – | Moderate Decline |

| — | Strong Decline |

Outbound

Middle East – North America

Rates are on the rise from the Gulf, with limited space availability on this trade route. Additionally, ongoing conflicts in Israel may impact regional services.

Capacity — (+)

Rate — (+)

Middle East – Asia

The upcoming Golden Week has caused a slowdown in demand, resulting in decreased rates and increased space availability departing from the Gulf. Persistent conflicts in Israel may disrupt service flow in this area.

Capacity — (-)

Rate — (-)

Middle East – Europe

Rates are showing a gradual decrease or stability when departing from the Gulf, though service disruptions due to the Israel conflict are a concern. Despite Europe being a major destination for goods from the Middle East, space remains generally available on this trade route.

Capacity — (=)

Rate — (=)

Middle East – Latin America

Space is relatively abundant from the Gulf, but rates continue to climb. The ongoing Israel conflict may affect services in this region.

Capacity — (+)

Rate — (+)

Inbound Updates

Asia – Middle East

Spot rates to the Gulf continue to stay low, with potential disruptions in services due to the ongoing Israel conflict.

Capacity — (=)

Rate — (=)

North America – Middle East

Regular blank sailings are observed from South Atlantic ports, resulting in tight space availability. However, more options are opening up along the Northeast Coast. Additionally, there is an improving capacity from the US West and Gulf Coasts, yet space remains constrained.

Capacity — (=)

Rate — (=)

Latin America – Middle East

Rates remain generally stable on this trade route, although space availability can be volatile. The ongoing Israel conflict may impact regional services.

Capacity — (=)

Rate — (=)

Europe – Middle East

Capacity and spot rates remain steady on this trade lane, with the announcement of a GRI from November 1 for WMED and Arabian Gulf.

Capacity — (=)

Rate — (=)

Air Freight Highlights for November 2023

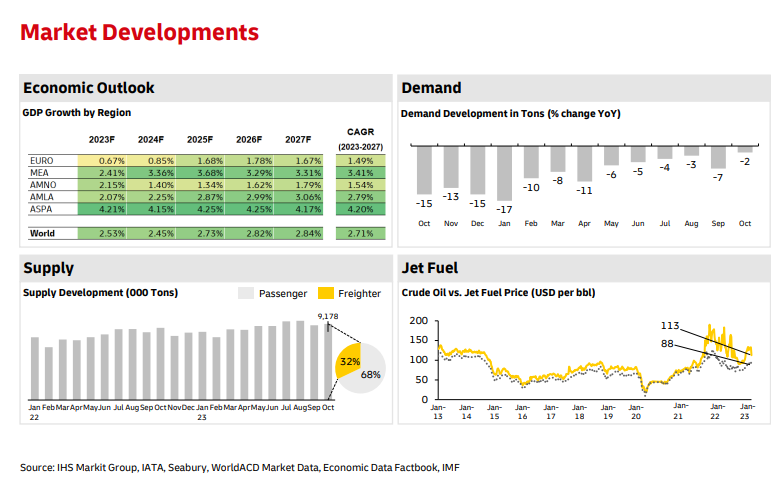

Demand: The volume remains steady, experiencing a slight month-to-month increase. Anticipated global inflation relief is attributed to stringent monetary policies and lower commodity prices.

Capacity: The industry exhibits a stable and resilient trend, with capacity consistently on the rise since March 2023. Notably, air cargo capacity is now 5% higher compared to October 2022, largely due to expanded belly capacity.

Rates: The market maintains its competitive nature, with slight rate upticks observed in specific trade lanes. The enhanced state of air cargo and rate stability are driving shippers towards long-term contracts.

The Middle East and Air Carriers

In the Middle East, cargo tonnages on routes from Asia Pacific are projected to surge by 8%. Pricing data suggests a modest 4% rate increase for cargo shipments originating from the Middle East & South Asia and bound for Asia Pacific. Additionally, there’s a substantial 13% boost in capacity from the Middle East & South Asia region compared to the previous year, signifying significant advancements in this particular market segment.

Asia

The introduction of new product lines has driven increased demand for technology products. Coupled with ongoing e-commerce demands, this surge has led to tight capacity and rising rates on select trade routes. This trend is expected to persist through the year-end holiday and gifting season.

America

The flower season in Colombia is underway, spanning from the end of September to the end of October. This seasonal shift is expected to boost exports, resulting in tight space availability, particularly for dry cargo. Capacity constraints to Central America are attributed to routing and aircraft adjustments. Moreover, import rates from Asia Pacific are rising due to China’s economic recovery, the peak season, and mid-autumn holidays.

Conversely, North America is experiencing a notable milestone, as IATA reports indicate year-over-year growth in monthly air cargo demand for the first time in 19 months. While global freight Ton Kilometers (CTKs) were previously below pre-pandemic levels, they have made a significant recovery, driven primarily by a 30% increase in belly capacities. Additionally, transported tonnage between North America and Europe has witnessed approximately a 6% increase in both directions.

Europe

Carriers are introducing new winter schedules from October, which might lead to a slight uptick in rates. Currently, the 4th quarter foresees no disruptions, as all airports, ports, and terminals are operating smoothly. Furthermore, capacity is readily available.

Local Shipping News – United Arab Emirates – November 2023

Hapag Lloyd has unveiled an ‘Online Business Suite,’ offering customers a centralized hub for all online solutions. Learn more

DP World has introduced new payment processes for Terminal Handling Charges (THC) payment process for Importing Full Containers, Terminal Handling Charges (THC) payment process for Exporting Full Containers, and Truck Loading / Unloading Charges (TLUC) payment process for Exporting Full Containers, effective from November 1, 2023.

As per the directive from the Dubai Maritime Authority (DMA), OOCL will no longer collect Terminal Handling Charges (THC) for import or export at Jebel Ali, UAE. Instead, the terminal will directly collect TLUC, THC, and THD from customers, starting from November 1, 2023. Read More

A.P. Moller – Maersk is regularly adapting to changes in the list of restrictions for Russia, with recent adjustments made for iron and steel products. Read More

Maersk, in collaboration with the Dubai Maritime Authority (DMA), is now issuing Digital Delivery Orders through Dubai Trade’s ‘Digital Delivery Order’ service for Jebel Ali Port of Discharge. The soft launch took place on October 20, 2023, with the official go-live date set for November 1, 2023. Learn More

Maersk has updated the process for ICD nominations concerning import shipments to Dar es Salaam. Read More

The Ministry of Commerce, Government of Pakistan, has issued Statutory Regulatory Order (SRO) no. 1397 (I)/2023, effective from October 3, 2023, to address the smuggling of items imported by Afghanistan in transit through Pakistan. Read More

The Dubai Maritime Authority has made it mandatory, as per Article 15 of a Decision, for service providers to present invoices and collect payments related to Digital Delivery Orders via the Dubai Trade Platform. This initiative aims to ensure transparency in Local Sea Container Charges in Dubai. For additional information, contact Maritime.Compliance@pcfc.ae.

The Ocean Network Express has expanded its service network, connecting Southeast Asia with India and the Middle East. Read More

DP World has introduced new anchorage services at Jebel Ali to enhance their service portfolio. Read More

The Security Industry Regulatory Authority has issued Circular No. (1) of 2023 regarding the Approved GPS Location Tracking System. Learn More

Starting from November 1, 2023, all shipments from Ghana, including those in transit, must obtain an Electronic Cargo Tracking Number/Smart Port Note (ECTN/SPN) from the ports of loading. Read More

CMA CGM has announced Bunker Adjustment Factor (BAF) updates for Algeria, Tunisia, and Morocco RoRo services. Read More

ESL has implemented a General Rate Increase (GRI) that will impact the flow of goods from Jebel Ali to Far East, Southeast Asia, Middle East, Red Sea, and the Indian Subcontinent, effective from November 1, 2023. Read More

CMA CGM has announced Freight All Kinds (FAK) updates for cargo shipments from Asia to North Europe. Read More

Global Factory Output – November 2023

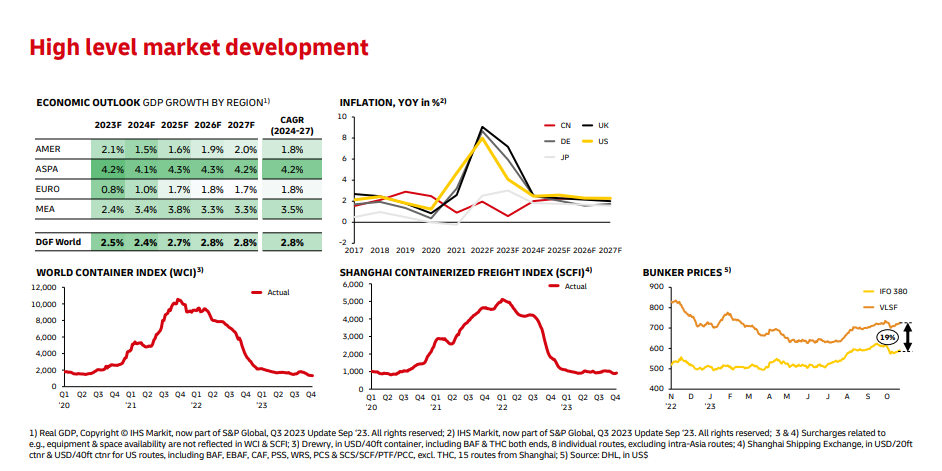

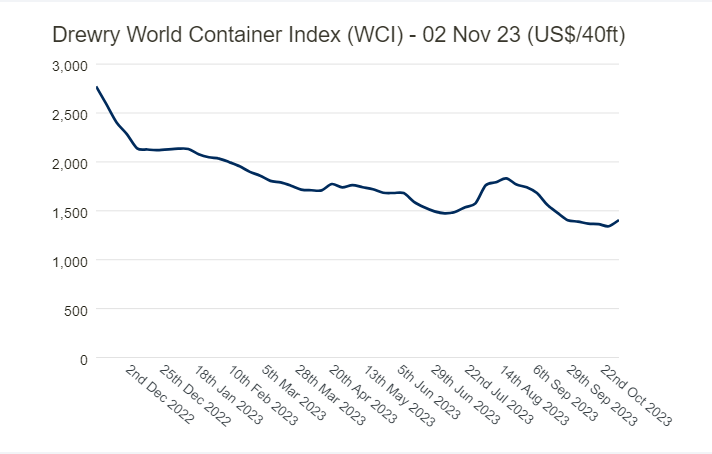

The World Container Index (WCI) has reported a 5% increase in rates for 40ft containers, now standing at USD 1406.

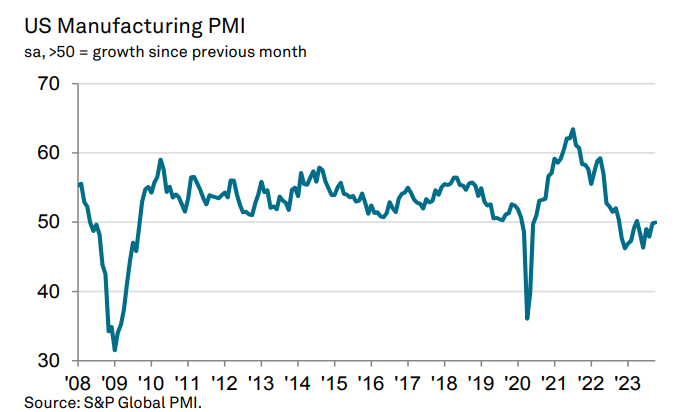

United States of America (USA)

During October, the Purchasing Managers’ Index (PMI) data for the United States signaled a stabilization in the manufacturing sector. This stability was driven by increased new orders and stronger output growth. However, the notable improvements were primarily concentrated within the domestic market, as new export orders experienced a more pronounced decline. Manufacturers also grappled with rising costs, prompting them to adjust their output charges in response to inflationary pressures and gaining momentum in the sector. This inflation was notably driven by increased prices of oil and oil-derived inputs, marking the third consecutive month of acceleration in inflation.

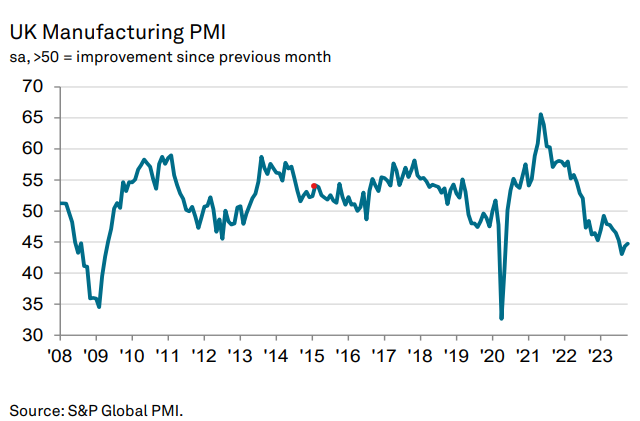

United Kingdom (UK)

In October, the seasonally adjusted S&P Global / CIPS UK Manufacturing Purchasing Managers’ Index (PMI) showed a slight uptick, reaching 44.8 compared to 44.3 in September. However, it remained below the earlier flash estimate of 45.2. All five sub-components used to calculate the PMI reflected deteriorating operating conditions in the manufacturing sector for the month. This decline was characterized by lower new orders, reduced output, declining employment, a decrease in stocks of purchases, and improved supplier delivery times, which typically signal weak demand in the sector.

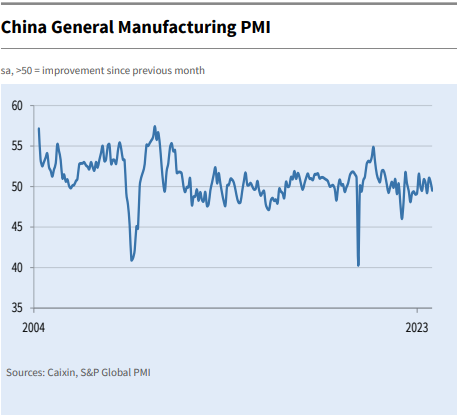

China

In October, the seasonally adjusted Purchasing Managers’ Index (PMI) for China’s manufacturing sector dipped to 49.5, falling below the neutral 50.0 threshold, indicating a slight contraction in manufacturing conditions. This marks the first instance of deterioration since July, although it remains marginal. The PMI provides a concise snapshot of the operating conditions within the manufacturing economy.

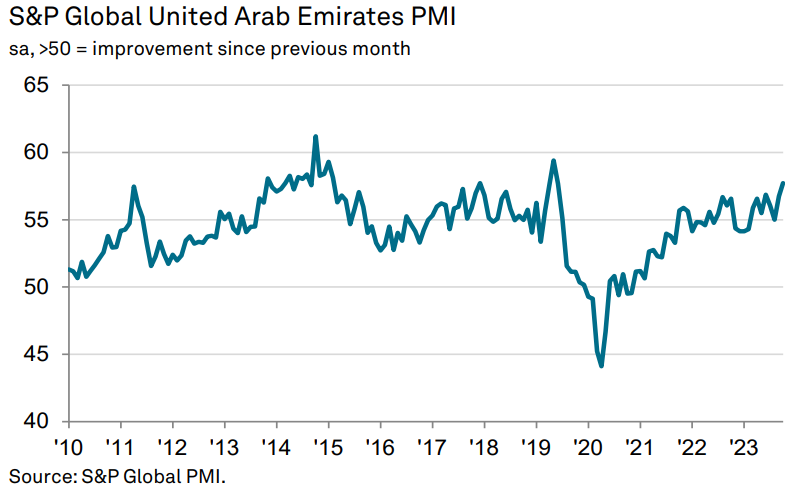

United Arab Emirates (UAE)

During the final quarter of the year, the non-oil sector in the UAE continued to enjoy robust economic conditions. The PMI results for October revealed a recent record for new business growth, with new orders expanding at the fastest rate since June 2019. This buoyed a significant increase in output. Strong business confidence suggests this momentum will persist, as predictions for the year ahead were among the most optimistic since March 2020. However, there were signs of mounting inflationary pressures affecting pricing strategies, as overall cost burdens increased at the fastest rate in five months, leading to higher output prices. This may result in an upturn in headline inflation, which dropped to a recent low of 1% in July, in forthcoming reports.