Retail & Consumer Industry in a Snapshot – December 2023

In the rapidly evolving landscape of consumer technology retail, businesses are navigating a complex environment marked by high inflation and evolving consumer expectations. Retailers are strategically adapting to these challenges, investing in key areas such as formats, technology, operational excellence, and purpose. This analysis delves into the growth strategies employed by consumer tech retailers, highlighting key trends in formats, technological advancements, operational efficiency, and the post-pandemic retail landscape. As the industry embraces a fusion of online and offline experiences, retailers are positioning themselves to thrive in the future by understanding and responding to evolving consumer trends.

Table of Contents

Post-Pandemic Retail Landscape

Omnichannel remains the most successful post-pandemic format. Furthermore, there is an expected anticipation of significant growth in mobile commerce, marketplaces, click-and-collect services, and sophisticated in-store experiences in the post-pandemic landscape.

Traditional and online businesses are converging, leading to a focus on unlocking new revenue streams within evolving formats.

Key Retail Priorities

Format Evolution

Significant format evolution, with tech superstores and cross-channel formats are dominating revenues in developed markets. Furthermore, emerging markets are witnessing a revolution with the rise of internet marketplaces.

Online Sales Growth

Retail websites are adapting with better personalized recommendations and streamlined transactions, which is increasing the market share for online sales across categories, driven by consumer digital maturity.

Future Opportunities

Retailers are gearing up for investments in rapidly changing physical and digital formats. Furthermore, growing comfort with digital channels opens up opportunities in social commerce and the metaverse.

Retailers worldwide are strategically investing in formats, technology, operational excellence, and purpose to position for growth. Understanding evolving consumer trends and making informed choices in these key areas are crucial for retailers to thrive in the future.

Consumer Tech Retailers’ Growth Strategies

Consumer tech retailers are adapting to a challenging environment marked by high inflation and increasing consumer expectations. The recent surveys identify crucial areas where retailers are focusing their investments: formats, technology, and operational excellence.

Retail Revolution Opportunities

Formats

Omnichannel, mobile commerce, marketplaces, and experience stores are key expectations. Traditional distinctions between online and offline retail are blurring, with businesses merging strategies for in-store and online experiences.

Technology

There is a growing emphasis on artificial intelligence, with a focus ahead of blockchain and robotics. Furthermore, there is recognition of the importance of innovative technology in enhancing operations and capturing new revenue streams.

Operational Excellence

In the retail industry, there are major investments in delivery, supply chain, workforce, and overall ecosystem excellence. Smart investments in essential workforces and intelligent technologies are priorities for most retail players.

Capturing Cross-Channel Growth in Retail

Retail executives foresee omnichannel as the dominant format in the next two to three years, with 79% expecting its success. The evolution in omnichannel involves expanding into new operational areas and ensuring seamless transitions for consumers.

Emerging Formats

Internet Marketplaces

These marketplaces are expected to become more widespread and successful as confidence in their potential with nearly two-thirds of respondents of different surveys. The rising competition with new marketplaces is a big challenge for established giants.

Shopping Experience Stores

These types of stores are anticipated to be successful, providing distinct and immersive encounters. About two-thirds of retailers around the globe express confidence in this format.

Click and Collect Services

The click and collect services are expected to remain popular, offering speed and convenience. This format will particularly experience significant growth in Latin America, addressing challenges in home delivery.

Social Commerce

This is not universally recognized as important in the near term,’ however, over half of retailers consider it so. A rapid growth expected in Asia-Pacific, where consumers are accustomed to buying directly through social media apps.

Generating New Revenue Streams

Innovative Use of Space

Recognized as a key concept for generating new revenue streams. 54% of retailers expect revenue from renting out physical space for smart displays, kiosks, and enhanced retail experiences.

Digital Space Utilization

The interest in developing Retail Media Networks (RMNs) is notable (45%). RMNs serve as a digital equivalent to in-store ads, allowing retailers to sell advertising space on websites and apps.

Focus on In-Store Services

Traditional shops are considering new in-store services to compete with their online counterparts. Nearly four in 10 are exploring experiences like events and food hospitality.

Revenue Generation through Fulfillment Options

The retailers are utilizing areas for store or curbside pickup, last-mile delivery, and outsourced shipping. Furthermore, large omnichannel players are also focusing on these options.

New Approaches for Retailers

The new approach includes emphasis of retailers on using physical and digital spaces effectively to evolve relationships with manufacturers and remain vital channels.

Technology and Operational Excellence in Retail

Following are the technological updates in the retail industry:

Technology

Critical Technological Changes

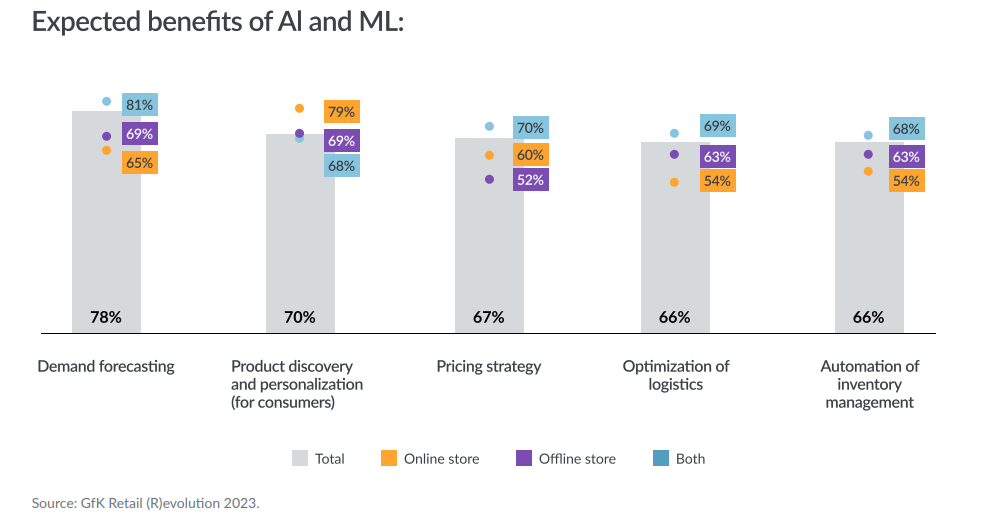

Retailers are considering crucial technological changes to support new formats, revenue streams, operational excellence, and purpose-based activities. However, some hesitancy is observed in tech investments, particularly in artificial intelligence and machine learning (AI and ML).

AI and ML Investment

Over six in 10 retailers consider AI and ML as crucial technologies. Despite recognition, there is only moderate strategic focus on this aspect, potentially due to perceived long payback times and sophistication in data harnessing.

Emerging Technologies

Currently, Augmented Reality (AR), Virtual Reality (VR), blockchain, and robotics are perceived with somewhat less significance. AR and VR are favored more by retailers with a physical presence. Whereas robotics, mainly for warehouse automation, sees interest, especially among online operators. However, more integration of these emerging technologies can prove handy for the retailers. Blockchain can assist in fraud prevention, supply tracking, and sustainability in the coming years.

Operational Excellence

Focus on Delivery and Product Availability

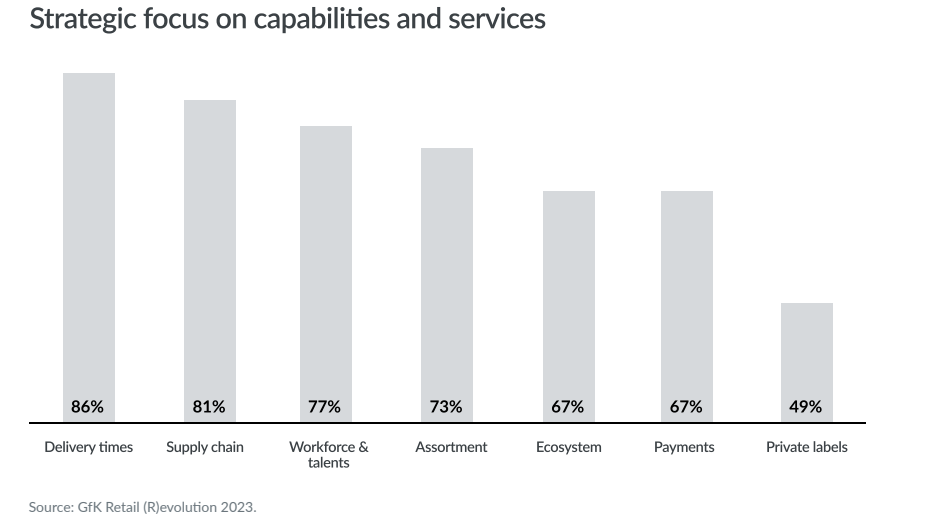

Consumer concerns about delivery times and product availability have increased post-pandemic, which is why retailers should recognize the importance of efficient internal operations to meet consumer expectations.

Improving Delivery Processes

Nearly nine in 10 consumer tech retailers focus on improving processes for faster and more flexible product delivery. They aim for clear strategic focus across online and offline stores to enhance efficiency.

Supply Chain Operations

81% of retailers plan to tighten supply chain operations in the next two to three years. Balancing efficiency in the supply chain is crucial to offering attractive ranges and obtaining/shipping products quickly.

Assortment Improvement

Almost three-quarters of consumer tech retailers will invest in improving their range amid recognizing that choices of available items matter in consumer decisions.

Retailers are navigating technological advancements cautiously, with a focus on AI and ML while considering other emerging technologies. Whereas operational excellence remains a top priority, emphasizing efficient delivery processes, supply chain optimization, and assortment improvement to meet evolving consumer expectations.

Developing Ecosystems

Focus on Ecosystem Expansion

67% of retailers plan to expand their ecosystem of services, with high attention across the industry. Online players emphasize retail media networks (RMNs) for extra revenue and brand insights.

Other ecosystem services include in-store entertainment, education, healthcare, and private labels.

Payment Services and Subscription Options

Over two-thirds of retailers target new payment services, influenced by strong demand in the Middle East and Africa. Whereas nearly a third of retailers work on subscription options to enhance customer relationships.

Tech and Workforce Excellence

Technology and Workforce Investment

Recognizing the complexity and expense of ecosystem changes, retailers prioritize strong technology and a skilled workforce. Workforce and talent development are high strategic priorities for all types of retailers.

Role of Robotics

Retailers, especially online operators, consider robotics to fill staffing gaps, focusing on behind-the-scenes operations.

Consumer Expectations and Sustainability

Rising consumer demands requires retailers to have a clear purpose, including a focus on sustainability. Sustainability encompasses selling recycled products, extending product life, minimizing packaging, and greener internal practices. For instance, Gen Alpha and Gen Z particularly prioritize ethical and environmentally conscious retailers.

Global Variances in Sustainability Focus

Based on several research, European retailers show significantly more focus on sustainability compared to Asia-Pacific and Latin America.

In the coming years, we will see strong emphasis on improving packaging, using recycled materials, and educating consumers about sustainability. Whereas there will be limited attention to offering repair hubs, selling second-life products, and improving warranties.

Challenges and Opportunities

Some of the common challenges and opportunities for retailers include:

- Some retailers prioritize sustainability but face challenges due to perceived lack of consumer demand or revenue upside.

- Opportunities for significant gains by embedding sustainability into core operations, winning new customers, and building loyalty.

- Predicted growth in consumer tech retailers making significant changes around purpose, with a focus on environmental sustainability.

Logistics Challenges and Trends in Retail & Consumer E-Commerce in 2024

The ever-evolving e-commerce has been reshaping the retail industry, providing consumers with unparalleled convenience. Companies are adapting to the dynamic environment; however, some logistics challenges accompany this transition that hinders effective logistics management vital for businesses to succeed.

Geopolitics played a major role in logistics in 2023, along with rising transportation costs and inflation. This has led the companies to adopt new strategies, which are also expected to lead the industry in 2024.

Here are some of the other challenges and trends shaping the e-commerce logistics in the coming years:

Rise in Returns – Providing Opportunities for Loyalty Initiatives

Within the realm of e-commerce shopping, delivery experience, including flexibility in delivery options, quick and free shipping, and return process plays a pivotal role. These options also play an important role in retaining the customers. Based on research by Cubyn, a leading e-fulfillment and e-commerce robotics provider in France, almost 96% of the customers consider the delivery experience as a basis for future purchases. They are also geared towards elevated experience like mobile or voice shopping.

However, introducing these methods may lead to impulse shopping that leads to growing returns. This poses a big logistical challenge for the e-commerce players, along with creating complexities in inventory management.

Moving forward in 2024, many businesses are turning this logistical challenge into an exclusive opportunity to build customer loyalty. For instance, Amazon’s started the Amazon Prime Model, that provides the regular customers with more personalized experience. Such incentives have not only been proven to increase customer loyalty but also increase their average expenditure with the brand. A 2020 study by McKinsey and Co shows that the shopper’s part of loyalty programs spends 30% more than the non-members, and if they are a full member, this number jumps as high as 60%.

Increase in Transportation Costs – Resulting in Greater Road Availability

For an online shopper, quick and accurate delivery is not just a competitive edge but a basic requirement. The challenge of timely and precise order fulfilment has become more crucial, especially during peak seasons and promotional periods. This is further compounded by an increase in the transportation costs; mainly due to rising energy and wage expenses.

However, there’s another factor in play that counteracts the challenge of rising transportation costs; i.e., the decreasing cost of roads. The availability of roads across the globe has increased, which has increased the competition among road freight operators, leading to substantial decrease in spot rates. Based on a study by Transporeon, the capacity index in Europe skyrocketed by 22.7% in March 2023 in comparison to same month last year.

Optimizing Logistics by harnessing AI opportunities

With the ability to perform predictive analysis, AI can help retailers in forecasting customer demand, inventory management, and planning efficient routes. Furthermore, AI can also incorporate weather forecast to identify the potential impact along the industry value chain. Such information helps optimize routes for logistics by finding out the shortest distance between two points, avoiding the traffic disruptions.

Furthermore, integrating the AI technology into the supply chain also allows for route optimization by providing drivers with useful information. This assists with efficient refueling and lunch break locations, reducing stop duration. All these benefits further lead to minimized fuel costs and increased transportation efficiency and sustainability.

Sustainable Transport for Better Efficiency

Collaborative partnerships are thriving in the industry between the logistics service providers and e-commerce companies to develop solutions for shared warehousing, optimized transportation, and multi-modal delivery systems. Such initiatives not only reduce costs but also streamline the operations. For instance, H&M, Puma, and Maersk are collaborating to adopt sustainable practices of supply chain.

Some of the other trends that are expected to lead the industry in 2024 include hyper-personalization in delivery using advanced analytics.

Reatil & Consumer E-Commerce Fulfillment in the UAE and Middle East

Here’s all the news and updates from the UAE for December 2023:

Yalla!Hub’s MENA E-Commerce Community Transformation

Under Leo Dovbenko’s leadership, Yalla!Hub’s MENA E-Commerce Community is reshaping the Middle East’s e-commerce landscape, offering a platform for entrepreneurs to network, share insights, and stay updated on industry trends. The recent event, “Latest Trends in the eCommerce Industry,” featured expert discussions on marketing strategies and adapting to evolving consumer behaviors. With over 280 membership applications within six days, the community is gaining significant traction, emphasizing the need for a professional hub in navigating the dynamic Middle East market.

Omniful Secures $5.85M to Transform Middle East eCommerce

Omniful, a supply chain and e-commerce startup, has raised $5.85 million in seed funding led by VentureSouq, with participation from key investors. The platform’s advanced systems for ordering, warehouse, and transport management aim to revolutionize retail in the UAE and Saudi Arabia. Omniful’s technology streamlines order management, enhances inventory control, and reduces fulfillment time by up to 70%, making it a transformative force in the industry. The startup plans to expand its reach to Africa and India after establishing success in the MENA region.

MENA Shoppers Demand Transparency and Flexibility in Online Shopping

DHL’s 2023 Online Shopper Survey reveals that 67% of MENA shoppers engage in cross-border purchases, with a strong emphasis on delivery options and transparency. The survey highlights their preference for free, next-day delivery (69%) and a significant demand for free returns. MENA shoppers express a willingness to spend more for sustainable delivery, with 42% in the UAE emphasizing sustainability. The report underscores the importance of delivery providers in the online shopping experience and the need for retailers to address consumer expectations for flexible and transparent delivery services.

Combatting Digital Deception in UAE: Emirates Post Group’s Response

Abdulla Mohammed Alashram, CEO of Emirates Post Group, discusses the escalating threat of digital scams in the UAE’s evolving e-commerce landscape. Highlighting phishing, deceptive messages, and fraudulent emails impersonating Emirates Post, he emphasizes the vulnerability induced by quick decision-making in the face of the fear of missing out. The UAE, addressing cybersecurity challenges, has established entities like the UAE Cyber Security Council and implemented stringent laws. Alashram underscores Emirates Post’s commitment to combat fraud through security measures, international partnerships, and a shift to verified WhatsApp communications. The collective responsibility lies in fostering awareness and collaboration to ensure a secure digital environment in the UAE.

Omniful Raises $5.85M in Seed Funding for E-commerce Enablement (h3)

Supply chain and e-commerce startup Omniful emerges from stealth with $5.85 million in seed funding led by VentureSouq. The UAE- and KSA-based company provides systems for ordering, warehouse, and transport management, enabling efficient hyperlocal and omnichannel commerce for merchants. Omniful’s technology, used by large enterprises and small merchants, aims to reduce workforce costs and fulfillment time significantly. The startup plans to expand its global customer base, including regions like Africa and India.

Saudia Cargo, Cainiao, and Worldwide Flight Services Strengthen Collaboration to Optimize Global E-commerce Logistics

Saudia Cargo, Cainiao, and Worldwide Flight Services (WFS) are reinforcing their collaboration to enhance global logistics operations, focusing on streamlining processes and adopting innovations. The partnership involves establishing a dedicated area in the air cargo station of Cainiao Liege eHub in Belgium to meet the growing demand for high-quality logistics operations in cross-border e-commerce, particularly in the Middle East and European markets. The collaboration includes specific Saudia Cargo freighter flights from Hong Kong to Riyadh and Liege. The initiative aims to redefine the industry landscape, offering innovative and customer-centric solutions for seamless e-commerce material flow. The strategic collaboration is set to inaugurate on March 1, 2024, aiming to transform global logistics and set new benchmarks in efficiency and innovation.

UAE Expects E-commerce Market to Soar to $9.2 Billion by 2026, Embraces Sustainability in Global Trade

The UAE anticipates its e-commerce market to reach $9.2 billion by 2026, emphasizing the pivotal role of digitization and advanced technologies in sustaining global supply chains. Foreign Trade Minister Thani bin Ahmed Al-Zeyoudi highlights the urgency of embracing technological advancements to address climate challenges. He emphasized the importance of green trading and positions the UAE as a key player in reinforcing global supply chains’ efficiency and sustainability. The minister underscores the role of e-commerce in reducing carbon emissions, aligning with the ongoing technological revolution.

Conclusion

In conclusion, the future of consumer technology retail hinges on a holistic approach encompassing omnichannel strategies, cutting-edge technology adoption, operational excellence, and a clear sense of purpose. As traditional distinctions between online and offline retail blur, retailers are embracing new formats such as omnichannel, marketplaces, and experience stores. The emphasis on artificial intelligence, coupled with investments in delivery, supply chain, and workforce excellence, reflects a commitment to staying ahead in a competitive market.

Looking ahead, the convergence of physical and digital realms opens doors to innovative revenue streams in social commerce and the metaverse. Sustainability and consumer expectations are pivotal, with a focus on eco-friendly practices and transparency gaining prominence. The challenges and opportunities in logistics, especially in the e-commerce realm, underscore the need for adaptive strategies, leveraging technologies like AI and sustainable practices.

As the consumer tech retail landscape continues to transform, retailers must remain agile, attuned to global trends, and committed to delivering seamless and sustainable experiences. The strategic initiatives outlined in this analysis serve as a roadmap for retailers seeking not only to survive but to thrive in the dynamic and competitive world of consumer technology retail.

![Freight Market Update Air & Ocean [November 2021]](https://www.qafila.com/wp-content/uploads/2021/11/Freight-Market-Update-Air-Ocean-November-2021-400x250.jpg)