Freight Market Update: Air & Ocean [September 2021]

Table of Contents

Freight Market Updates September 2021

The Topic of the Month

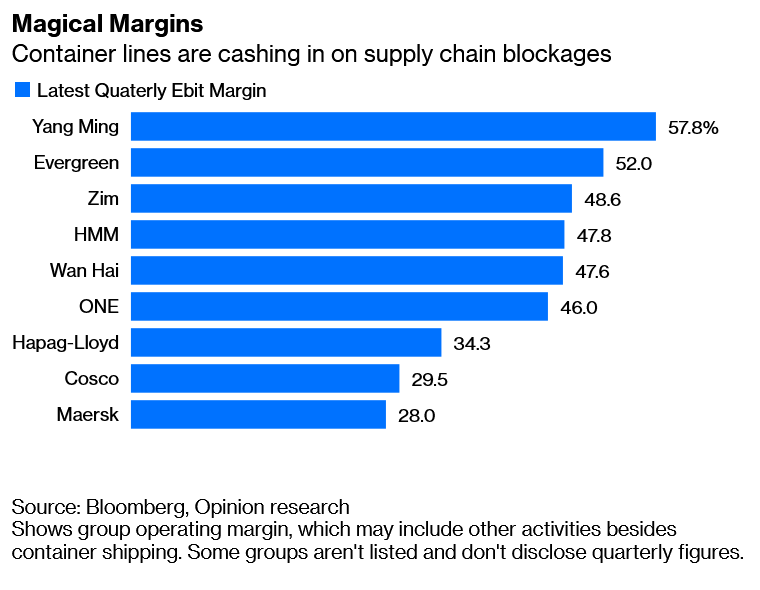

Many of the Ocean Shipping Carrier have released their earning in the last quarter and it seems like they are finally making money after years (almost a decade) of being in the red.

Contrary to popular opinion that Ocean Shipping carriers are forming a cartel of some sort to take advantage of the opportunity, that is not true. Ocean Carriers have chartered and ordered additional vessels, order additional equipment, doing everything within their reach to cool off the hot freight market. Prediction is that this market will continue right up to the next year 2022.

Keys

| Sign | Meaning |

| ++ | Strong Increase |

| + | Moderate Increase |

| = | No Changes |

| – | Moderate Decline |

| — | Strong Decline |

Ocean Freight Market Updates September 2021 United Arab Emirates

Outbound Ocean

ME – North America

One line Status: Rates have cooled down a little with just a moderate increase in price. PSS/GRI has been applied by most of the carriers as noticed in July.

Local Rates – Moderate increase from August 2021, GRI will be implemented by Hapag on 1st of September (++)

Effective September 15, 2021, Hapag Lloyd implement GRI in the USA and Canada

Local Space – Limited (-)

Local Capacity/Equipment – Limited but available on selected carrier (-)

Notes: Reservations must be made 2-3 weeks ahead of time

ME – Europe

One line Status: Rates increasing, space is limited, and only premium rates are available. Carriers like light-weight cargo.

Local Rates – No increase from August 2021 (++)

- Effective September 1st, 2021, CMA CGM announced Freight All Kind (FAK) rates from MiddleEast to North Europe

- Effective September 16, 2021, CMA CGM announced Freight All Kind (FAK) from the Middle East Gulf to North Europe

- Effective September 15, 2021, Hapag Llyod announced Tariff Rates from the Middle East to North Europe

- Effective September 16, 2021, CMA CGM announced PSS from the Middle East to North Europe, Scandinavia, Poland, the Baltic, and the Black Sea.

Local Space – reduced from August 2021 (–)

Local CapacityEquipment – equipment is available but bookings are limited but available on the selected carrier at a premium (-)

Notes: Reservations must be made 3-4 weeks ahead to secure

ME – Africa

One line status – Bookings for West Africa are only released against “Sea Priority / Shipping guarantee on most lanes in Africa, Space is only available for bookings made at least 3-4 weeks in advance. Carriers have reduced their allocation ex GCC. The situation seems stable with GRI implemented by carriers for East Africa

Local Rates – Prices are on a general increase (+)

- Effective September 15, 2021, Hapag Lloyd will implement GRI to East Africa from UAE

- Effective September 16, 2021, CMA CGM announced FAK from the Middle East Gulf to North Africa.

Local Space – Critical and low for West Africa, relevantly at ease for East Africa (-)

Local Capacity/Equipment – available (-)

Notes: Maersk Spot for 2 weeks in advance and Priority is given to cargo utilizing “Shipping Guarantee” cargo

ME- Mediterranean MED

One line Status – Rates are increasing, space is limited and only available to premium rate level cargo.

Local Rates – Prices are on a general increase (+)

- Effective September 1st, 2021 till September 14, 2021, Hapag Lloyd announced Tariff Rates to the Mediterranean from MiddleEast

- Effective September 1st, 2021, CMA CGM announced Freight All Kind (FAK) rates from MiddleEast to East Mediterranean

Local Space – Limited but at a premium (-)

Local Capacity/ Equipment – Available

ME – ISC (Intra Gulf Service)

One line Status — Equipment availability is steady and rates are stable as compared to August 2021 to escalate.

Local Rates – Price is on a general increase (+)

Local space – available (-/=)

Local capacity/ Equipment – available

Notes Reservations must be made 2-3 weeks ahead to secure

ME – Far East Asia

One line status– Costs have risen, owing to a lack of equipment for goods heading for Asia. To decrease turnaround time, carriers prefer to relocate empty boxes rather than loaded boxes. Free time at the destination has been reduced.

Local Rates – Price is on a general increase (++)

Local Space – Limited Space (-)

Local Capacity/Equipment – available (=)

ME – China

One line status – Costs have risen, owing to a lack of equipment for goods heading for Asia. To decrease turnaround time, carriers prefer to relocate empty boxes rather than loaded boxes. Free time at the destination has been reduced.

Local Rates – Price is on a general increase (++)

Local Space – Tight Space (-)

Local Capacity/Equipment – available (=)

ME – Oceanic

One line status – From the United Arab Emirates Prices are elevated

Local Rates – (+)

Local Space – (-)

Local Capacity/Equipment – (=)

ME – Latin America

One line status – No carriers accepting bookings as the sector due to limited allocation. The situation is expected to remain the same as previously in August 2021.

Local Rates- Prices are on a general increase (++)

- Effective August 15th, 2021, Hapag Lloyd implement GRI East Coast of South America

Local Space – Very tight (–)

Local Capacity/Equipment – (=)

Inbound Ocean market update the United Arab Emirates

North America

One line status – The US West Coast continues to experience delays in LA while both Oakland and Seattle have seen schedule delays and bunched-up sailings worsen in recent weeks.

Local Rates – One carrier announced GRI for Mid Augusts, while others are aiming for the first week of August.

Local Space – Tight from US West Coast. The US East Coast is showing signs of improvements in available spaces. In the US Gulf space has increased with capacity more readily available

Local Capacity/Equipment – Capacity tightest from the US West Coast. Equipment and chassis are tight at most ports and all ramps.

Notes – Book 4+ weeks out.

AsiaPacific

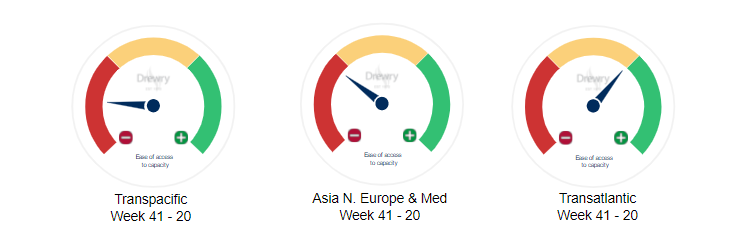

One line Status – Rates generally continue to trend upwards as demand remains strong. The absence of fresh capacity release from schedule and congestion delays creates persistent tension on space.

Local Rates – moderate increase (+)

Local Space – Critical (-)

Local Capacity/Equipment – Under capacity (-)

Europe

One line status – Space seems tight throughout August with additional blank sailings and this trend seems to creep well into September and October.

Local Rates – Rate slight increase (+)

Local Space-– Super tight (–)

Local Capacity/Equipment- (–) but will get better in mid-August

Latin America

One line status – Tight space, equipment situation, and structural service changes leading to increases in Q3. Challenges: Protests in Columbia waned towards the end of July, but the effects on an already strained market will continue to be felt. The port strike/closure in Durban disrupts already fragile schedule integrity.

Local Rates – Rate increase (+)

Local Space – Super tight (–)

Local Capacity/Equipment – (=)

Indian SubContinent (ISC)

One line status– Carriers are adding blank sailing to re-align schedules. Equipment is an issue across India as inland container depots are also facing critical shortages

Local Rates– Rate increase (+)

- Effective September 1st, 2021 till September 14, 2021, Hapag Lloyd announced Tariff Rates to the Mediterranean from ISC

- Effective September 1st, 2021 till September 14, 2021, Hapag Lloyd announced Tariff Rates to North Europe from ISC

- Effective September 15, 2021, till September 14, 2021, Hapag Lloyd announced GRI from the Indian Subcontinent (ISC) and the Middle East to the USA and Canada

Local Space—Critical (-)

Local Capacity/Equipment – (=)

Air Freight Market Updates September 2021 for the United Arab Emirates

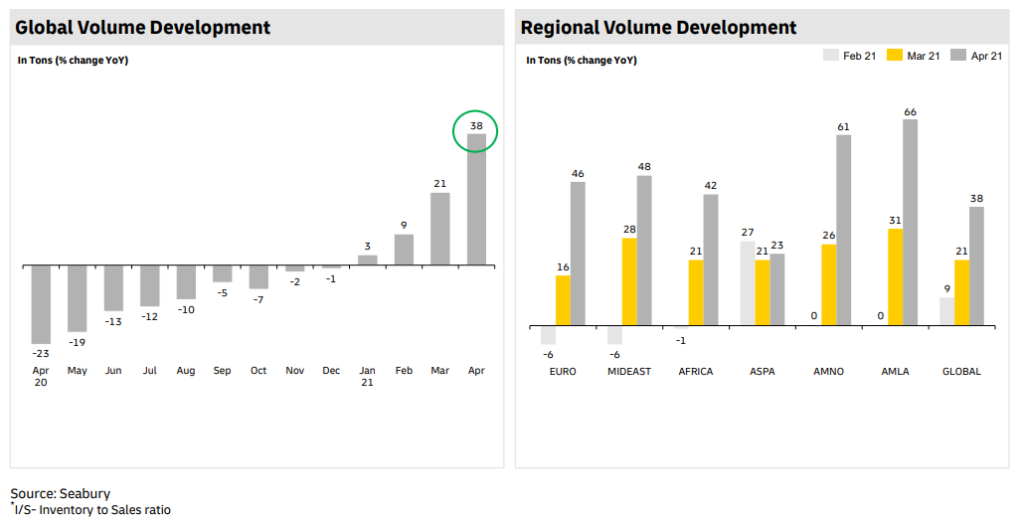

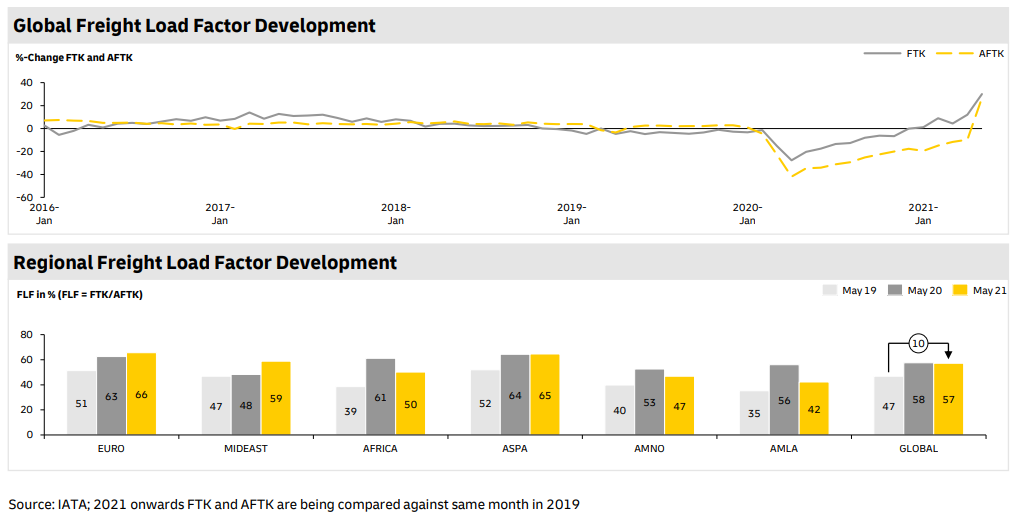

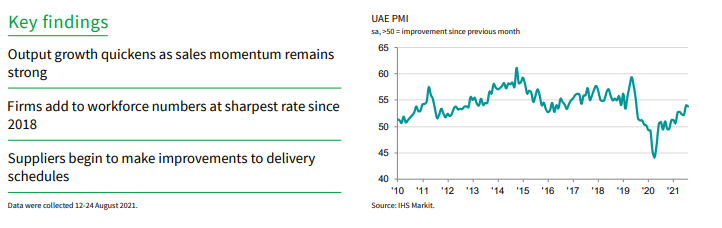

Air Freight Demand – demand surge still spread across various sectors from hi-tech, high-value shipment to pharma. Ecommerce has also contributed to solid demand. Port Congestions, extremely high ocean rates on the east-west trade, and urgent seasonal inventory restocking continue to convert previously ocean-reliant cargo to air. The healthy PMI index still projects sustainable air cargo demand growth going forward.

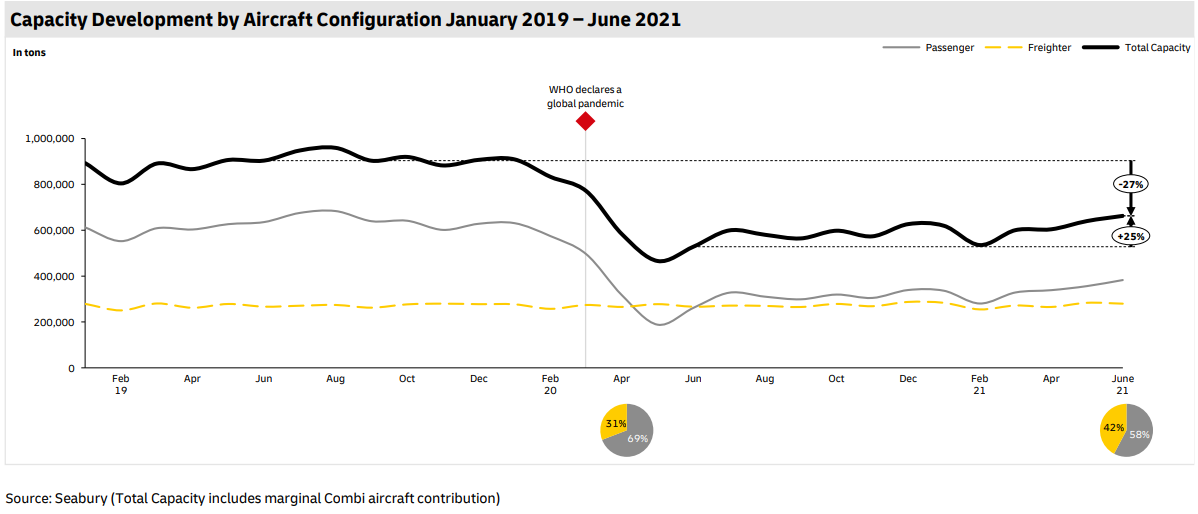

Carrier Capacity – The increase in capacity appears to be much slower than the demand, and therefore rates and load factors are expected to remain high in the short term. The latest wave of COVID restrictions in Europe and across other regions could potentially affect the market’s speed of recovery in 2021 as capacity is restricted. A return to pre-pandemic capacity is not feasible in the short term.

Local Rates – Freight rates increased further up from May 2021 even though May 2021 has seen +80% higher air freight rates as compared to May 2019 and +7% higher than the high of May 2020.

The Middle East and Air Carriers ME

Some flight restrictions to impacted regions have been imposed in the United Arab Emirates. The operation of freighters and Pax cargo flights is limited due to capacity constraints. Terminals are functioning regularly for cargo, but with a reduction in staff, which has a detrimental effect on efficiency. In KSA, no passenger planes are permitted to arrive or depart. Except in the case of belly passengers for freight.

Carriers based in the Middle East posted a 17.1% increase in their international air cargo volumes in June 2021 vs June 2019, boosted by strong performance on the ME-Asia and ME-Nth Am trade lanes.

Asia

The effect of Typhoon In-Fa has caused the PVG TPEB airfreight market rate in August 2021 to rise slightly. Market rates are comparable to last week in the remaining lanes and other significant origins like HKG and TPE.

The rest of Asia’s market circumstances differ from country to country, and from city to city. Two countries act as effective examples. Because of Samsung, HAN space in Vietnam is limited, and SGN is still under lockdown. MAA has been put on lockdown in India, whereas DEL has resumed production.

Europe

Terminals in the United Kingdom are functioning regularly for cargo, but with less staff, which is affecting efficiency. Passenger flight restrictions are widespread; freighters are flying normally, although capacity is limited. Turkey’s economy has slowed dramatically. In terms of general business, the Izmir office has been severely hit. Terminals are running regularly for cargo – only PAX flights have been disrupted. There is enough capacity in the market to meet this demand; expect a PAX injection from the UK, which will open its borders to fully vaccinated US/EU visitors.

North America & South America

In Los Angeles and Houston, freighters are flying normally, although capacity is limited. Restricted operations affecting freight planes in Miami. Only PAX flights were disrupted; cargo terminals remain normal in San Diego.

While no significant capacity is built, export demand from the United States remains fairly constant and consistent. Large shipments from all major export gateways in the United States may take 2-3 days to uplift into major European destinations from the time they are booked Due to insufficient capacity, the majority of airlines are refusing to take bookings. In the mid-term, the situation is anticipated to stay unchanged in Latin America.

Local Updates the United Arab Emirates, September 2021

Logistics News September 2021

Hapag Llyod has updated Local Charges / Service Fees and Detention & Demurrage Effective 01 Oct 2021 the local charges will increase for Hapag Lloyd from UAE. Read More Here

Hapag Llyod has updated Regional Terminal Handling – Effective 01 Oct 2021 the local terminal charges will increase for Hapag Lloyd from UAE. Read More Here

Revised Demurrage from the 1st Sep 2021 by MSC, Revise Demurrage Charges for all inbound shipments applicable from 1st September 2021 into Jebel Ali, Ajman, Fujairah, Sharjah, Khorfakkan, Ras Al Khaimah, and Umm Al Quwain ports.

Hapag Llyod has announced Heavy Lift Charges (HCL) applicable from October 1, 2021, for all Middle East Trade for inbound trade routes. Read More Here

Hapag Llyod has announced Marine Fuel Recovery Surcharge (MFR), effective from October 1, 2021, It is valid for both directions and shown as a separate surcharge on your invoice and freighted Bill of Lading. Read More Here

Hapag Llyod has launched a payment option in the ODEX platform which will offer an immediate payment confirmation after paying Hapag Llyod invoices. Read More Here

CMA CGM has implemented a Late Payment Fee for Cross Trade Shipments, Effective from September 1, 2021. Read More Here

CMA CGM has decided to stop all spot rate increases effective immediately from September 9, 2021, and until February 1, 2022. Read More Here

Freight All Kinds (FAK) Rate increase by CMA CGM

CMA CGM announced Freight All Kinds(FAK) rates increase. Effective from September 1st, 2021 Trade from the Middle East Gulf to North Europe and East Med. Read More Here

CMA CGM announced Freight All Kinds(FAK) rates increase, Effective September 1st, 2021 from Middle East Gulf to North European, Scandinavian & Polish, and East Mediterranean Trades (W/B). Read More Here

CMA CGM announced Freight All Kinds(FAK) rate increase. Effective September 16, 2021, From the Middle East Gulf to North Europe, Med, and North Africa. Read More Here

Tariff Rates by Hapag Llyod

Effective September 1st, 2021 till September 14, 2021, Hapag Llyod announced Tariff Rates for all cargo transported in 20’ and 40’ General Purpose Containers (incl. High Cube Container) from Indian Subcontinent to the Mediterranean. Read More Here

Effective September 1st, 2021 till September 14, 2021, Hapag Llyod announced Tariff Rates for all cargo transported in 20’ and 40’ General Purpose Containers (incl. High Cube Container) from MiddleEast and Pakistan to the Mediterranean. Read More Here

Effective September 15, 2021, Hapag Llyod announced Tariff Rates for all dry cargo transported in 20’ and 40’ general purpose containers (including high cube containers), from the Middle East and Pakistan to North Europe. Read More Here

Effective October 1, 2021, Hapag Llyod announced Tariff Rates for all dry cargo transported in 20’ and 40’ general purpose containers (including high cube containers) from Turkey to the Middle East & Indian Subcontinent. Read More Here

GRI (General Rate Increase) to/from the Middle East

ESL has increased General Rate Increase (GRI) from Indian Subcontinent and the Middle East to Zanzibar, Tanzania. Read More Here

Hapag Lloyd has increased General Rate Increase (GRI) applicable from September 15, 2021, from the Indian Subcontinent (ISC) and Middle East to the USA and Canada. Read More Here

Hapag Lloyd has increased General Rate Increase (GRI) applicable from September 15, 2021, the Arabian Gulf to East Africa. Read More Here

PSS (Peak Season Surcharge) to/from the Middle East

CMA CGM announced Peak Season Surcharges(PSS) applicable from September 1, 2021, From ECSA to North Europe, Baltic, Mediterranean, Black Sea, North and West Africa, Red Sea, Adriatic, Middle East, and India Subcontinent. Read More Here

Hapag Lloyd has announced Peak Season Surcharges(PSS) applicable from September 15, 2021, from Pakistan to ports in the Arabian Gulf. Read More Here

Hapag Lloyd has announced Peak Season Surcharges(PSS) applicable from September 15, 2021, from India to destinations in the Middle East. Read More Here

CMA CGM announced Peak Season Surcharges(PSS) applicable from September 16, 2021, from the Middle East Gulf to North Europe, Scandinavia, Poland, the Baltic, and the Black Sea. Read More Here

Hapag Lloyd has announced Peak Season Surcharges(PSS) applicable from October 1, 2021, from Pakistan to ports in the Arabian Gulf. Read More Here

Factory Output News September 2021

Middle East

Asia

Mainland The long-term decline in China’s economic development is resuming. Although the extent of the COVID 19 outbreaks is relatively minor, the zero-tolerance stance of the Chinese Government has significantly reduced commercial activity.

A rather modest development in vaccination camps outside mainland China complicates the propagation of the Delta variety. The effects have been severely influenced by consumption, tourism, industrial production, and exports. Production cutbacks due to pandemics have worsened input shortages and costs in Southeast Asia. In August and September, a semiconductor shortage led to additional worldwide car production cutbacks.

Europe

Western Europe will continue to boost consumer-led growth. The reduction of COVID-19, the improvement of labor markets, and household savings during the epidemic have triggered an increase in consumption.

The new policy framework and guidelines provided by the European Central Bank imply that monetary policy will remain extremely accommodating. The real GDP of the eurozone is predicted to rise by 5.0% in 2021, 4.3% in 2022, and 2.1% in 2023 following a 6.4% fall by 2020.

America

The expansion of the US economy is sustainable. Real GDP increased 6.5 percent quarter-per-quarter (q/q) annually in the second quarter. The decreases in residential investments, federal acquisitions, inventory investments, and net exports were partly compensation for strong growth in consumer expenditure and company fixed investments.

The annual real GDP prediction decreased by 0.5% to 6.1% by 2021 and by 0.6% to 4.4% by 2022. In the August 2011 estimate. The reviews show a decrease in growth by the year 2021, with reduced inventory investments in response to COVID19 infections, in the context of supply constraints and cautious consumer spending.

This Month’s Eye-catching News

- The shipping crisis is getting worse. Here’s what that means for holiday shopping (CNN)

- Finance is squeezed by ongoing rise in Air Freight (WSJ)

- Walmart to launch delivery service for other businesses (AP)

- Women Are Entering a Trucking Industry That’s Not Built for Them (Bloomberg)

- McDonald’s runs out of milkshakes amid ‘supply chain issues’ (The Guardian)

- Walmart charters ships to ensure freight capacity, inventory for peak season | Supply Chain Dive

- Tight ocean market, peak preparations drive strong demand for airfreight | Supply Chain Dive

- Air Cargo Boom in Supply Chain Crunch Has Car Tires Flying First Class – WSJ

- Top toymakers say their products will be harder to find and more expensive this holiday season – CNN

- Amazon plans to cut waste following backlash (cnbc.com)

- For Robot Trucks, Navigating Highways Is Just One Bump in the Road – WSJ

- Vietnam’s Supply Chain Role to Grow Despite Covid, U.S. Chamber Says | 2021-09-07 | SupplyChainBrain

- Global Supply Squeeze, Delta Virus Rip Through Factories | 2021-09-03 | SupplyChainBrain

- Container equipment prices double in the space of 12 months – Splash247

- Why filling Father Christmas’s sack will cost more this year | The Spectator

- Big retailers book pricey private cargo ships in holiday scramble (nbcnews.com)

- Container Shipping Earnings Now Rival Apple. It’s Not a Good Look

- Carriers are expected to set new financial records | Global Maritime Hub

- Cost of Moving Cars Across the Ocean Is at a 13-Year High – Bloomberg

- https://www.bloomberg.com/news/articles/2021-09-07/cost-of-moving-cars-across-the-ocean-is-at-a-13-year-high

- https://www.bloomberg.com/news/videos/2021-09-07/teledrive-a-step-before-autonomy-video

- https://www.bloomberg.com/news/articles/2021-09-02/global-food-prices-jump-back-near-decade-high-on-harvest-woes

- https://www.bloomberg.com/news/articles/2021-09-08/saudi-arabia-lifts-uae-travel-ban-weeks-before-dubai-expo-starts

- https://www.bloomberg.com/news/newsletters/2021-08-26/supply-chain-latest-global-shipping-snarls-to-linger-to-2022

- https://www.bloomberg.com/news/newsletters/2021-08-30/supply-chain-latest-one-stuck-container-in-shanghai-reveals-crisis

- https://www.bloomberg.com/news/newsletters/2021-09-08/supply-chain-latest-shipping-chaos-hastens-drive-to-automate-supply-chains

- https://www.bloomberg.com/news/newsletters/2021-08-30/supply-chain-latest-one-stuck-container-in-shanghai-reveals-crisis

- https://www.bloomberg.com/news/articles/2021-09-01/swiss-firms-choose-new-suppliers-as-pandemic-rewires-trade