Freight Market Update: Air & Ocean [July 2021]

Table of Contents

July 2021 Market Updates

As we are just coming out of the Yantian Port Closure shock whose ripple effect has been experienced across the supply chain. This shock comes after the Suez canal, the imbalance of trade that is being experienced across the globe. We have entered an era of elevated freight market where demand is still high but supply (raw material, transportation means) is limited.

Here are some Global logistics News Today for you:

Ocean Freight market updates and trends, July 2021

Outbound

ME – North America

Port Congestion affects rates and capacity: Rates continue to increase. PSS/GRI applied by all carriers. The space situation is tight. Bookings need to be placed 3 or 4 weeks beforehand. Carriers are not releasing the bookings for the USA East Coast due to the port congestion.

Local Rates – Prices are increasing on general trends

- Effective July 19, 2021, Hapag Lloyd will implement HLC (Heavy Lift Surcharge) from the Indian Subcontinent & Middle East to the USA and Canada

- PSS (Peak Season Surcharge) from Middle East Gulf, Indian Subcontinent, Egypt & Red Sea to Canada East Coast

- GRI from Indian Subcontinent and Middle East to USA and CANADA

- Effective from August 1st, 2021, CMA CGM will implement Overweight Surcharge (OWS) from the Indian Subcontinent, Middle East Gulf, Red Sea, Egypt to the US East Coast, US Gulf & Canada East Coast: [Source]

Local Space – Critical

Local Capacity /Equipment: Available

ME – Europe

Lightweight recommended – Rates continue to increase. Space is stable. Carriers preferring lightweight cargo.

Local Rates – Prices are on a general increase

Increase Ocean Tariff from the Middle East and Pakistan to North Europe

Local Space – Available

Local Capacity /Equipment: Available

ME – Africa

Get booking 3-4 earlier as space shrinks– Rates continue to increase. July is fully booked on major carriers. Space only available for bookings made at least 3-4 weeks in advance. Carriers releasing bookings against “Sea Priority/Shipping Guarantee” on most lanes. (DHL Source)

Local Rates – Prices are on a general increase

- Effective July 1, 2021, Hapag Lloyd will implement HLC (Heavy Lift Surcharge) from the Middle East to West and South Africa

- Effective July 18th, 2021, CMA CGM will implement GRI for All Cargo including Dry, Out of Gauge and Break Bulk (Reefer not included) from Upper Gulf and the United Arab Emirates to West Africa and South Africa with a Quantum $300 per Unit

- Effective from July 1, 2021, Hapag Lloyd will implement GRI for all cargo from the Indian Subcontinent and Arabian Gulf to West Africa and South Africa

- PSS (Peak Season Surcharge) from the United Arab Emirates into East Africa & Indian Ocean Island effective July 1, 2021

- Effective August 1st, 2021, Hapag-Lloyd implements GRI to West and South Africa: Source

- Effective from August 4th, 2021, CMA CGM comes up with General Rate Restoration (GRR) to EAST Africa. Mombasa Express/02S9B eta Jebel Ali

- Effective date 14th of August, 2021, Bill of Lading, CMA comes up with General Rate Restoration (GRR) Quantum $ 1000 per Unit. To West and South Africa. For all cargo including Dry, Out of Gauge and Break Bulk (Reefer isn’t included)

Local Space – Critical

Local Capacity/ Equipment: Available

ME – Mediterranean MED

Rising rates with tight space– Rates continue to increase. Space is tight and is available at premium rate levels. Carriers preferring lightweight cargo and releasing space for lightweight cargo more likely (Source DHL Page 18)

Local Rates – Prices are on a general increase

Local Space – Available

Local Capacity/ Equipment: Available

Recommendation: it is suggested to get the advance booking like 2 weeks before.

ME – IGS (Intra Gulf Service)

Equipment availability stable but rates increased compared to June. (Source DHL page18)

Local Rates – Prices are on a general increase

Local Space – available

Local Capacity/ Equipment: available

ME – Far East Asia

Rates on the higher side along with equipment shortage for Asia-bound cargo. As carriers prefer to reposition empty boxes instead of laden boxes to reduce the turnaround time. Destination free time reduced

Local Rates – Prices are on a general increase

Local Space – available

Local Capacity/ Equipment: Available

ME – China

Rates on the higher side along with equipment shortage for Asia-bound cargo. As carriers prefer to reposition empty boxes instead of laden boxes to reduce the turnaround time. Destination free time reduced (Source: DHL Page 18)

Local Rates – Prices are on a general increase

Local Space – Available

Local Capacity/ Equipment: Available

ME – Latin America

Bookings unavailable at least till June – No carriers accepting bookings as the sector due to limited allocation. The situation is expected to remain the same in June as well. (Source: DHL Page 18)

Local Rates – Prices are on a general increase

Local Space – Critical

Local Capacity/ Equipment: Available

Inbound Ocean Freight

North America

The West Coast of the United States continues to suffer the brunt of lost capacity. Few carriers have decreased the frequency in terms of their port calls of Seattle and Oakland, as a response to congestion. Carriers are prioritizing moving their empties back which makes the situation even difficult.

Local Rates – rate levels are seeing an uptick.

Local Space – Very tight from the US West Coast. A few ocean carriers are managing the US East Coast, even tightly because of the unavailability of space because of the vessels delaying.

Local Capacity Equipment: Capacity tight from the US East and West Coast. Equipment and chassis are tight at most ports and all ramps.

Europe

The situation is as same as in Asia. Many carriers placed EIS and PSS. There is a slight increase in rates. (DHL Ocean market update June 2021)

Local Rates – The rates during Q3 can rise due to strong volume performance and also cargo backlog.

Local Space – Critical, there is a high demand for all services.

Local Capacity Equipment: Equipment and space are reliable only with Premium rates. The carriers are compelled to adjust their official schedules due to the current port congestion and vessel delays. New blank sailings are going to reduce capacity in weeks 29-31 to USWC

China

Local Rate – July 1 GRI + July 1 PSS implemented, and with a July 1 BAF change, rate levels are seeing an uptick.

The Shanghai Containerized Freight Index(SCFI) has breached the mark of 3,000 points in May for the first time after many weeks of increasing rates consecutively. The index of Chinese exports showing the evolution of average spot rates stands now at record 3,343 high points. Average spot rates from Shanghai to North Europe increased by 16% in May. Source: DHL June 2021 Market Updates

Local Space – China Yantian port situation is having a negative effect on scheduling and equipment availability.

Local Capacity Equipment: Extremely critical space situation

Recommendation: Use premium services. Moreover, split VIP POs into LCL shipments to find space for many containers. To reach large base ports, at the destination, and even at origin, you should avoid out ports requiring an extra leg. You should book in advance at least 4-6 weeks before CRD.

Local UAE Ocean Carrier Updates and logistics news – July 2021

Carriers

Hapag Introduced a new booking window by June 26 /2021 for shipping from UAE, Qatar, Kuwait, Qatar, Bahrain, and Iraq. Read more here

One (Ocean Network Express ) will soon implement a fee for any manual booking functions received other than their web page & electronic channels across all trade from UAE. Implementation will kick off on July 15/2021

Maersk’s Vessel Monta Vessel Delays: Due to increased covid cases and recovery delay for onboarding crew members said vessel is delayed by almost 3 weeks from Jebel Ali. ETA notifications are already triggered for subscribed users. It is expected to sail by 22nd June 2021 at midnight as per the latest updates received from the operation team.

Hapag: Effective July 1, 2021, Hapag Lloyd will implement HLC (Heavy Lift Surcharge) from the Middle East to West and South Africa and will be applicable for cargo (+ tara) exceeding a weight of 25 tons. Read more here

Hapag: Effective July 19, 2021, Hapag Lloyd will implement HLC (Heavy Lift Surcharge) from the Indian Subcontinent & Middle East to the USA and Canada and will be applicable for cargo (+ tara) exceeding a weight of 18 tons. The HLC (Heavy Lift Surcharge) will apply for all 20’ reefer, Dry, non-operating reefer, tank, flat rack, and open-top containers that have a payload above 18MTs.

Maersk makes HS Code mandatory for the destination ports in Russia. 6 digit HS code should be mentioned for all commodities in case of multiple commodities.

Revision of Line Detention Charges in UAE effective 1st June 2021

Maersk does not accept any Iran-owned Containers. The penalties and fines would be inflicted if the Iranian-owned containers are found which are identified by the following prefixes: TDIU, HDXU, IRSU, FURU and BANU.

Hapag-Lloyd acquires NileDutch carrier which leads to its growth in West Africa: Source

HLC: USD 1400 per 20′ container

Applicable origins: Indian subcontinent: India, Bangladesh, Pakistan, and Sri Lanka. Middle East: UAE, Bahrain, Oman, Qatar, Kuwait, Saudi Arabia, Iraq, and Jordan.

The detention and demurrage update amid the political unrest in South Africa by Hapag Lloyd. Source

Hapag Lloyd– Effective from July 23, 202, the rates would be increasing from Bahrain to the Indian Subcontinent and ME. Source

Effective 15th to 31st August 2021, Bill of Lading date, CMA CGM comes up with GRR(General Rate Restoration) Quantum $ 1000 per Unit. To West and South Africa. For all cargo including Dry and Reefer

Effective from 1st August 2021 onwards and will remain valid until further notice, Hapag-Lloyd will adjust the Heavy Lift Charge (HLC) on the westbound trade from China to the Arabian Gulf and the Red Sea. Source

GRI From Gulf to West Africa and South Africa – CMA CGM & Hapag

CMA CGM – Effective July 18th, 2021, CMA CGM will implement GRI for All Cargo including Out of Gauge, Dry, and Break Bulk (Reefer not included) from United Arab and the Upper Gulf Emirates to West and South Africa with a Quantum $300 per Unit

Hapag – Effective from July 1, 2021, Hapag Lloyd will implement GRI for all cargo from the Arabian Indian Subcontinent Gulf to West Africa and South Africa

Reference: Indian Subcontinent countries include Bangladesh, India, Sri Lanka, and the Maldives

Arabian Gulf: United Arab Emirates, Bahrain, Iraq, Kuwait, Oman, Pakistan, Qatar

West Africa: Angola, Benin, Senegal, Côte d’Ivoire, Mali, Mauritania, Ghana Nigeria, Senegal

South Africa: South Africa

PSS (Peak Season Surcharge) from the United Arab Emirates into East Africa & Indian Ocean Island

Emirates Shipping (ESL) effective July 7th, 2021, ESL will implement PSS on all equipment from the United Arab Emirates to East Africa.

PSS Quantum : USD 150/20 & USD 150/40

CMA CGM effective July 1st, 2021 All cargo from Origin United Arab Emirates to East Africa and the Indian Ocean island

To East Africa Countries ie Tanzania and Kenya, there will be a Quantum of USD 150/Unit on all the types of cargo

To Indian Ocean Island countries ie Mozambique, Somalia, Comoros, Mayotte, Madagascar, Reunion, Seychelles, Mauritius, Maldives, there will be a Quantum of USD 300/Unit on all cargo types.

Jebel Ali Port Terminal revised THC

At Jebel Ali effective from 1st July 2021 (Sail date) the quantum of TERMINAL HANDLING CHARGES (Export and Import) at Jebel Ali terminal is going to be revised as below :

Scope: All shipments to AEJEA (Imports)

Quantum:

20 / 40 DRY – AED 740 / 1160

20 / 40 DG – AED 1105 / 1735

Scope: All shipments from AEJEA (Exports)

Quantum:

20/ 40 DRY – AED 1060 / 1480

PSS (Peak Season Surcharge) from Middle East Gulf, Indian Subcontinent, Egypt & Red Sea to Canada East Coast

CMA CGM is effective July 1, 2021, all cargo originating from the Indian Subcontinent, Middle East Gulf, Red Sea, and Egypt to Destination to Canada East Coast.

Quantum: USD 300/20′ | USD 400/40′ | USD 600/45′ (all types)

GRI from Indian Subcontinent and Middle East to USA and CANADA

Hapag. Starting on July 15, 2021, With an effective date of July 15, 2021, rates from the Indian Subcontinent and the Middle East to the United States and Canada will increase.

Container Types: applies to dry, reefer, non-operating reefer, tank, flat rack, and open-top containers Container sizes: 20’ standard and reefer: USD 960 per container 40’ standard, high cube and reefer: USD 1200 per container

For your reference, the geographical scope of these changes is listed as follows: Indian subcontinent: India, Bangladesh, Pakistan, and Sri Lanka. Middle East: UAE, Bahrain, Qatar, Oman, Kuwait, Jordan, Saudia Arabia, and Iraq. Read more here

Increase Ocean Tariff from the Middle East and Pakistan to North Europe

Hapag Lloyd – Effective July 1st, 2021 there will be an increased Ocean Tariff rate for all cargoes for 20’ and 40’ General Purpose (incl. High Cube Container) on the Trade – Pakistan, the Middle East to North Europe. Quantum will be around USD 200 Per Container

Shipping updates from Karachi, Pk to the Arabian Gulf

Hapag Lloyd– Announces upcoming changes in rates for shipping from Karachi, Pk to the Arabian Gulf. Source

Air Freight market updates and rates, July 2021

Europe

Demand remains steady as the larger shipments continue to be in the market from all across Europe. This is expected to continue specifically, for the Italian and Portuguese exports throughout July. The factories have halted their production due to the summer break.

The capacity is still enough in the market according to demand. As the operation gets better in the US, a few airlines have decided to change their freighters back again as passenger aircraft.

The reduction might occur in the capacity of PAX due to the rapid growth of the Delta variant of Covid in the UK. (From the 1st July, PAX FROM LHR has been under a ban). The freighters, however, should better be operating still without any restriction.

There is an increase in jet fuel price this weak, and the carriers are increasing the fuel surcharge as of 1st July.

No reports from EU hubs of any congestion for import and export. The volumes of cargo are reported to be high according to FRA but they are manageable.

Advice as same as last week’s, ‘better book early to have best levels of rates.’ You should remain open to split across 2 to 3 uplifts for any larger shipments to ensure the best options for any larger shipments.

America

During the month and quarter-end, export capacity is still fully utilized. It can take 2-3 days for major consignments to be uplifted into key European locations, primarily from the West Coast, from the time they are booked (WC). The Midwest and East Coast have the most restrictive capacity from WC gates, whereas the Midwest and East Coast have plenty.

No space is available in Bangladesh, India, Indonesia, and Nepal at least till July as the relief and aid reach this COVID-stricken region.

Ground handlers are compelled to use off-airport facilities at LAX and ORD. They are experiencing a backlog of two to five days as the breakdown of import freight. The cargo for export isn’t able to be tendered, before the actual flight departure, earlier than at least two days.

Trucking is still short for airport deliveries and local pickup, especially in LAX, JFK, and ORD.

100% screening for all Airfreight cargo will be in effect as of July 1st, 2021!

Asia

South and North China exports are rising and strengthening in demand as the month and quarter-end. Due to the ocean-to-air conversions, backlog in ocean markets generates further demand.

Reduced industrial output due to Covid limitations and increased ocean capacity (ships bypassing Yantian) have influenced airfreight demand in Taiwan, which has cooled significantly from its euphoric levels at the end of May. The rates have to the U.S have dropped around 3 to 4 dollars per kg just prior and they have stabilized at that level. A volume rebound is expected as Taiwan is to loosen the restriction levels by mid of July.

SEA(South East Asia) remains strong, mainly due to shrinking capacity. Indonesia is the most affected, with bookings taking over a week and additional flights to and from Indonesia being canceled. Thailand still is congested, whereas, the capacity in Vietnam is available.

ex-Middle East, LATAM, Africa the cargo is hugely boosted by the movement of perishables.

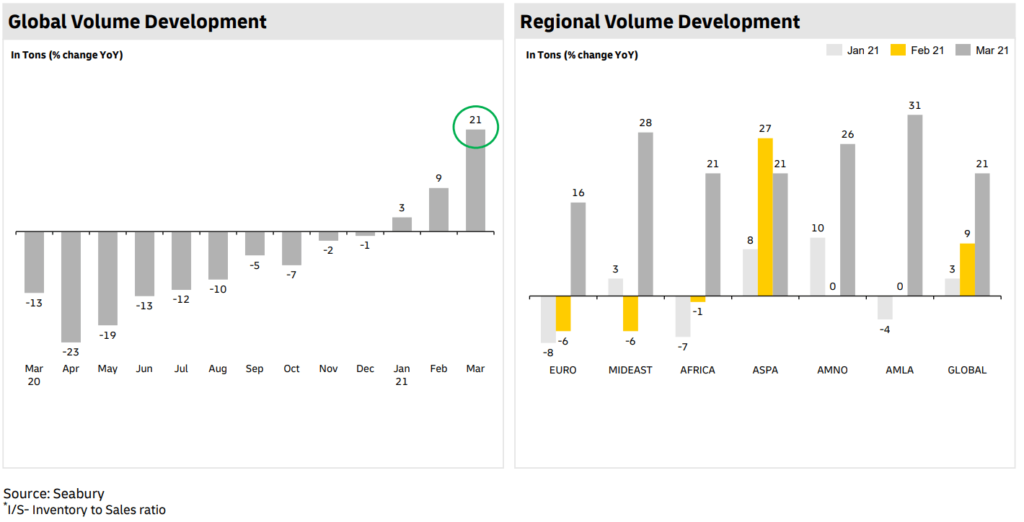

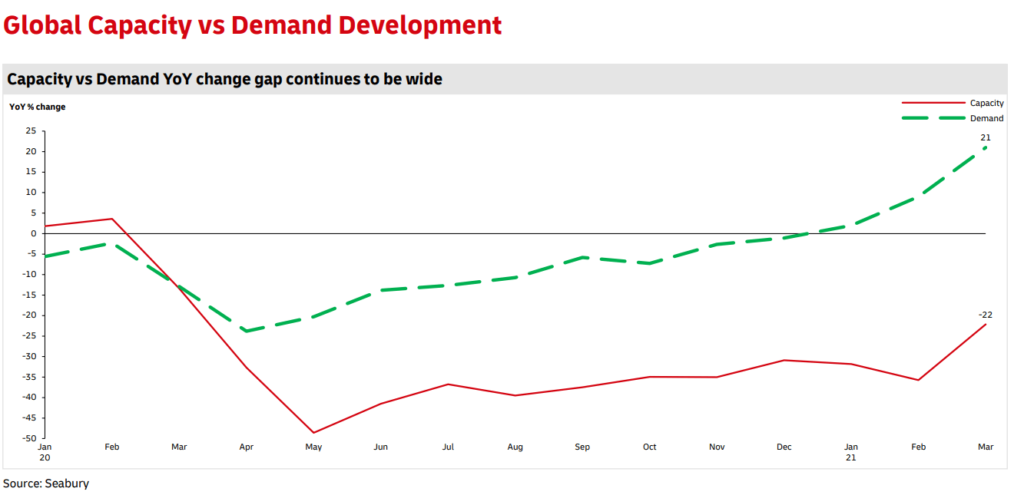

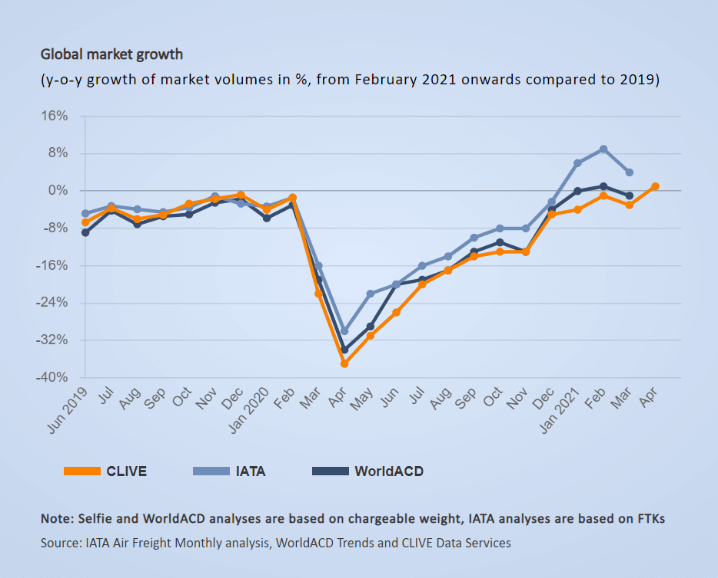

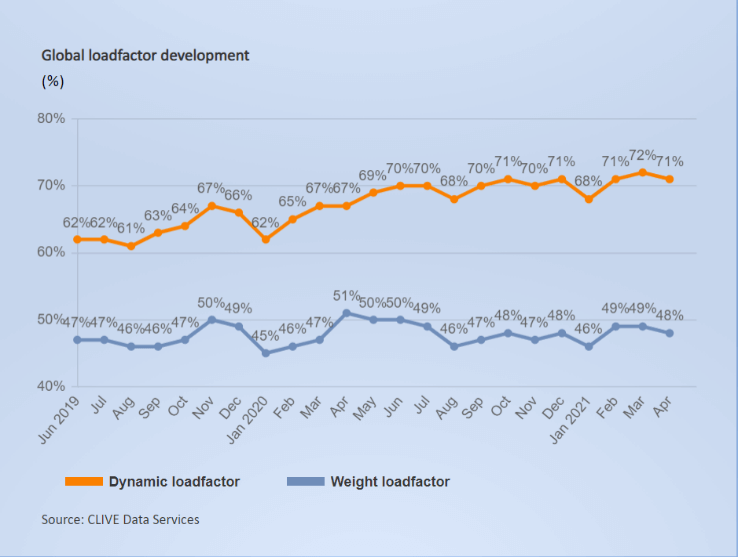

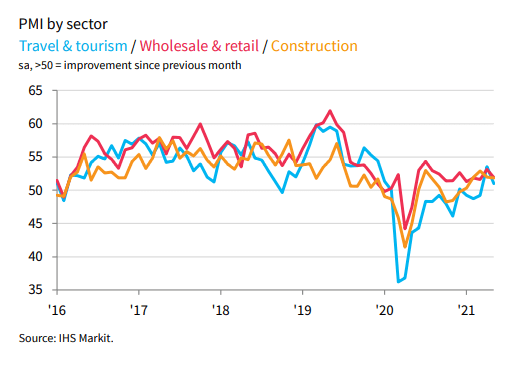

Interesting Graph for Air Freights

Source: PowerPoint Presentation (dhl.com)

• Cargo movements were active, boosting worldwide volumes.

• Freighter increase supported cargo movement in all regions

• Global capacity is still impacted, it is down by -29 percent compared to May 19. The impact of freighters can be seen in the increased capacity of freighters (FRT).

• The capacity of the transatlantic system has strengthened, and smaller EU members are driving the rebound

Analysis :

There were 77% higher rates in April 21st than the baseline of 2o19 and as compared to 2020 they were 8 % more.

Rates increased in April from March as manufacturers aim to replenish stocks faster using air freight further spiking demand vs capacity imbalance

Analysis :

According to IATA, “Air cargo has over-performed global goods trade in the three months to April. This is partly explained by the very low inventory-to-sales ratio, which is leading to an inventory restocking cycle, a common pattern at the start of an economic upturn. Moreover, other drivers of air cargo demand are also supportive

Capacity continues to improve at a slow pace – industry-wide available cargo tonne-kilometers (ACTKs) fell by 11.9% versus the three months to April 2019. Air cargo fares, revenues, and load factors continued to trend at elevated levels.”

Source: https://www.iata.org/en/iata-repository/publications/economic-reports/cargo-chartbook—q2-2021/

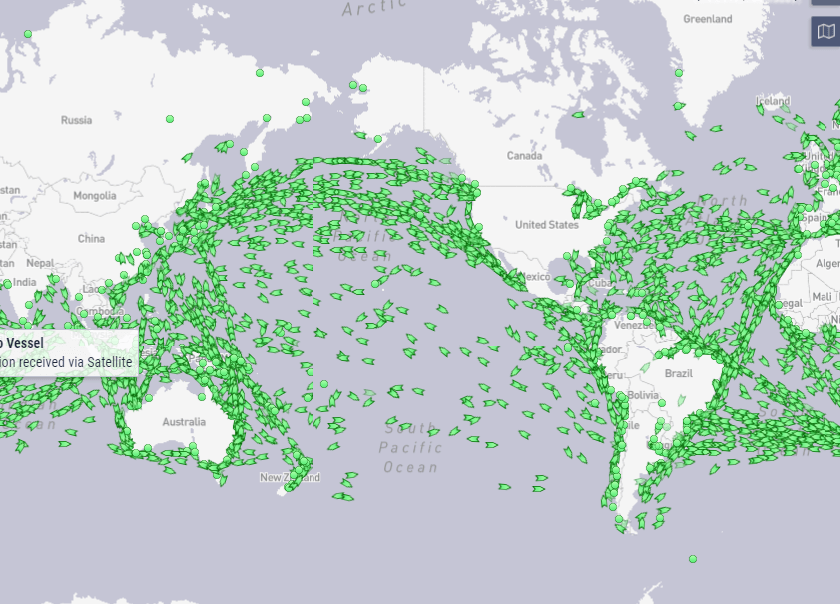

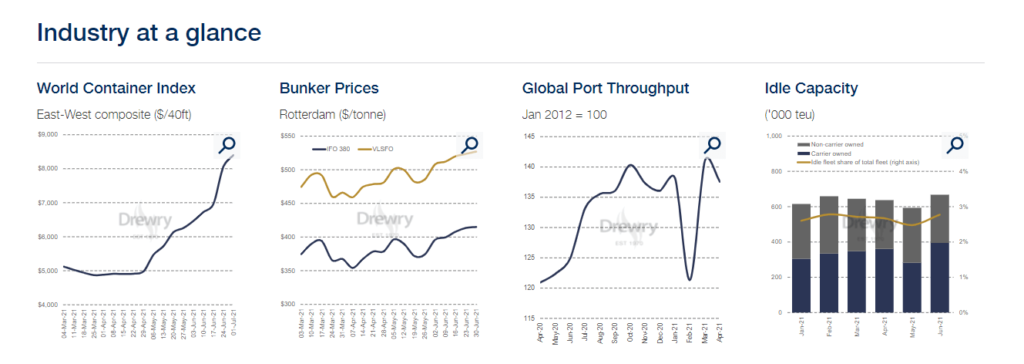

Interesting Graphs for Ocean Industry

Source: Drewry

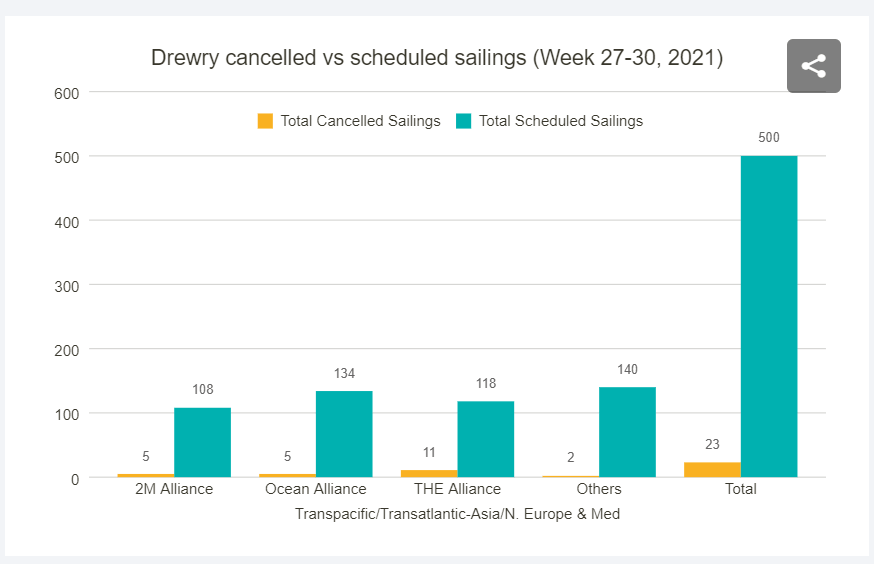

Source :Drewry – Service Expertise – Cancelled Sailings Tracker – 02 Jul

Analysis: Across the major trades: Transpacific, Transatlantic, and Asia-North Europe & Med, 23 canceled sailings have been announced between weeks 27 and 30, out of a total of 500 scheduled sailings, representing a 5% cancellation rate.

The Alliance has announced 11 cancellations over the next four weeks, followed by 2M and Ocean Alliance, each with five cancellations.

Through July, the overall number of canceled sailings for the major East-West trades will go down by 14% y-o-y, while the effective capacity deployed will see an increase of 13%, for the same period.

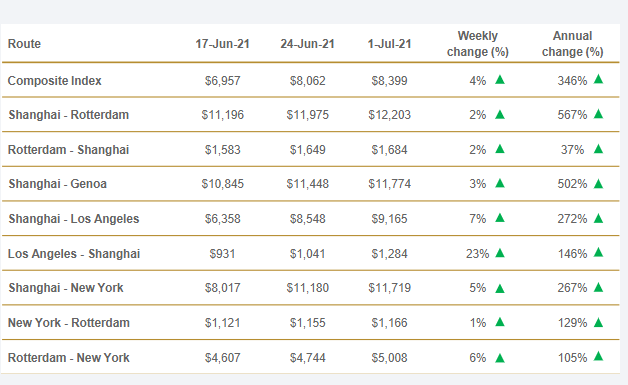

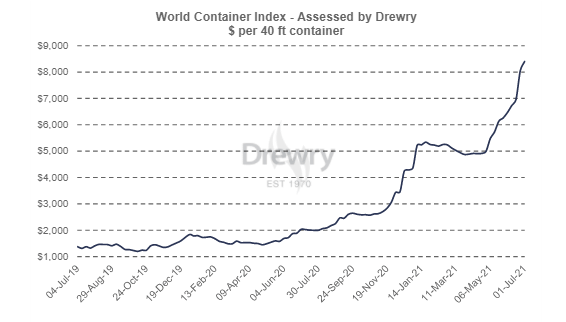

Source: Drewry – Service Expertise – World Container Index – 01 Jul

Analysis :

The average composite index of the WCI, assessed by Drewry year-to-date, is $5,643 per 40ft container, which is $3,628 higher than the five-year average of $2,015 per 40ft container.

Factory and Industry Update

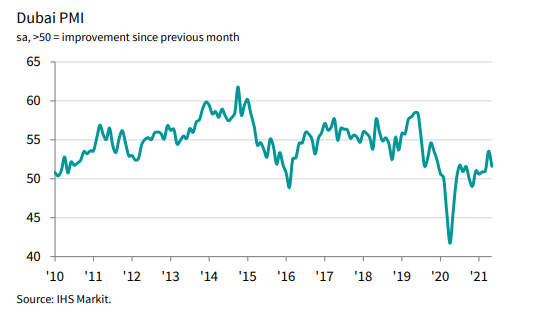

Dubai

Interesting news this week

US bans imports of solar panels linked to forced labor in China [Sustainability]

Zebra Technologies to acquire Fetch Robotics [Warehouse Innovation]

Warehouse Operators Turn to Wearable Technology to Solve Workplace Strains – WSJ [Warehouse Innovation]

ShipBob Raises $200 Million to Further Democratize Fulfillment [Ecommerce Fulfilment]

Tight Capacity on Shipping Lines Brings Record Rates, Delays – WSJ [Shipping]

DP World acquires syncreon, leading US based supply chain solutions provider [Ports Innovation]

Supply Chains Latest: Meat Is Getting So Expensive People Are Cutting Back – Bloomberg [Changing Consumers Behavior]