Freight Market Update: Air & Ocean [July 2022]

Table of Contents

Monthly Freight Market Update- July 2022

It’s all positive in terms of global production and services. However, the month has been eventful being affected by several factors and policies. A lookout on Europe shows the immense impact of the Ukraine-Russia conflict crippling consumer purchasing power. Insight into Asia is the biggest factor- the Covid-19 effect and policy resulting in city-wide lockdown. Inflationary pressure never failed to contribute to its quota.

As the conflicts near possible resolution and the ending of the lengthy lockdown, the forces of demand are expected to push up across several trade routes with the Middle East and the world.

Ocean Freight Market Update United Arab Emirates

Ocean Freight Market Updates July 2022 United Arab Emirates

Outbound Ocean

Keys

| Sign | Meaning |

| ++ | Strong Increase |

| + | Moderate Increase |

| = | No Changes |

| – | Moderate Decline |

| — | Strong Decline |

ME-North America

One line status – With the US experiencing a positive consumer demand, export volumes to North America are predicted to have a little increase. The demand is to pick up strides(+) in mid-July.

Local Rates – Currently mild, but may experience a moderate increase(+) due to the predicted uptick in demand in North America

Local Space – Limited (-)

Local Capacity/Equipment – Limited, port congestion in North America results in capacity loss and delay in return sailings.

Note: Early booking is recommended- 2-4 weeks before the expected date of departure(ETD)

ME-Europe

One line status – The European market is not in the best shape due to the Russia-Ukraine conflict. Consumer demand and spending have relatively dropped(-). However, a moderate increase(+) in demand is expected from July to August.

Local Rates – Rates remain soft

Local Capacity/Equipment – Available

Note – Reservation must be made ahead of time to avoid unforeseen capacity changes

ME-Africa

One line status – The demand is thriving in Africa as it picks up in South Africa and remains on a positive trend in West Africa and East Africa.

Local Rate – No significant change

Local Space – Limited(-)

Local Capacity/Equipment – Available (-)

Note – Book 2-3 weeks ahead of time to secure space against a rise in demand

ME- Mediterranean

One line status – Stable demand (=) and a predicted peak season in July. Port congestion in the Mediterranean(-), but still has an effect on services and operations.

Local Rate – Rate remains soft

Local Space – Open

Local Capacity/Equipment – Available, but advance booking is recommended.

Note – Reservation should be made well ahead of time- 2-4 weeks before.

ME- Asia

One line status – A strong demand is predicted, which will tighten local space. Glitches are present in exports to Pakistan due to the ban on luxury goods, and Sri Lanka hopes for a positive outcome in an energy crisis.

Local Rate – Possible increase in rates(+) due to export constraints and port situations

Local Space – Tight

Local Capacity/Equipment – Limited, due to the strong demand

Note – Book 2-4 weeks to secure space, equipment, and carrier

ME- China

One line status – The Chinese market is expected to recover due to the ending of the Shanghai lockdown. However, the resumption in activities will gradually ease the port congestions and delay sailings, affecting exports from ME.

Local Rate – Possible increase in rates (+)

Local Space – Tight

Local Capacity/Equipment – Limited

Note – Reservations should be made 4 weeks ahead of time.

ME- Oceanic

One line status – Strong demand to continue in July, leading to vessel sliding and port omission.

Local Rate – Possible increase rates (+)

Local Space – Open

Local Capacity/Equipment – Available

Note – Booking 2 weeks before the expected departure date is best despite the availability

ME- Latin America

One line status – Improved demand and a possibility for cargo rolling.

Local Rate – Remains Soft

Local Space – Relatively open

Local Capacity/Equipment – Limited

Note – Early booking 2-4 weeks ahead of time

ME-ISC(Intra Gulf Service)

One line status – Steady demand, rates, and equipment availability

Local Rate – Remains Soft

Local Space – Open

Local Capacity/Equipment – Available

Note – Booking 2 weeks before the expected departure date is best despite the availability

Inbound Ocean

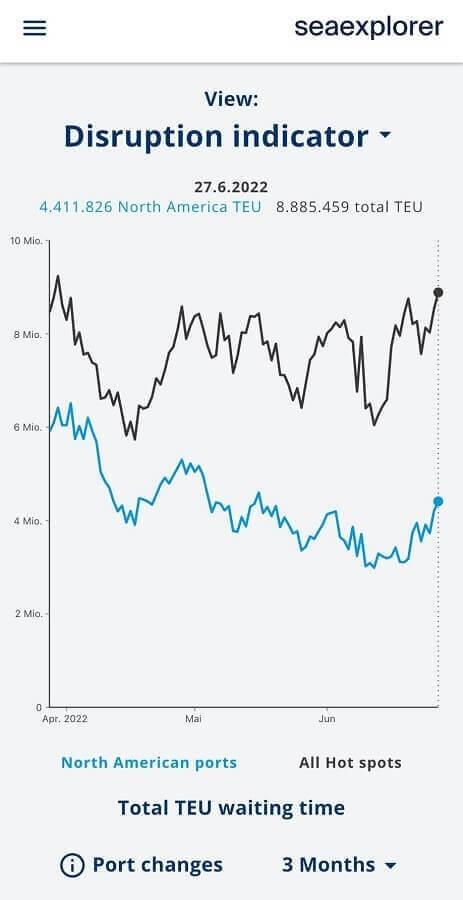

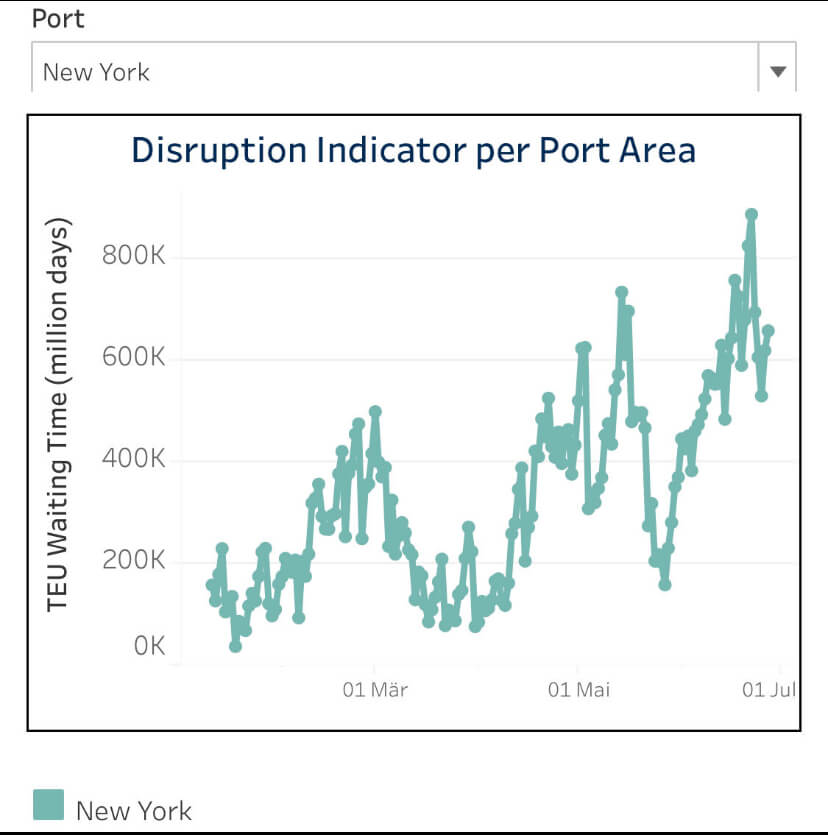

North America

One line status – There is significant port congestion, and expected capacity loss is in view. Significant port waiting times; Houston-14days, Vancouver-35days, Savannah-7days, Oakland-7days, Los Angeles-15days, Seattle- 2 days, and Prince Rupert- 10 days.

Local Rates – Possible moderate increase(+)

Local Space – Tight

Local Capacity/Equipment – severely affected, and vessels spend 50% longer at berth.

Note – Reservations should be made 4 weeks ahead of time.

Asia Pacific

One Line Status – Coming out of the Shanghai lockdown coupled with covid cases in Beijing and Tianjin, production and freight operation is still not in top gear. Japan is still impacted by capacity shortage.

Local Rates – May push up as activities look to recover

Local Space – Tight

Local Capacity/Equipment – Capacity shortage, extended waiting times, and port congestion.

Note – Bookings should be made 4 weeks ahead of time

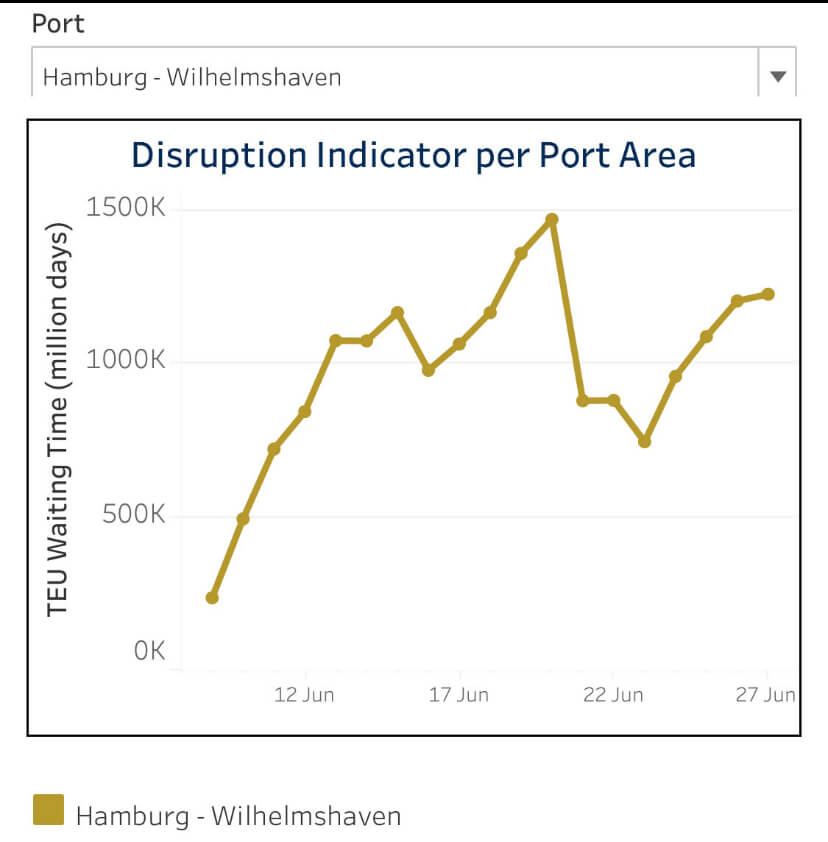

Europe

One line status – Stable demand across the European market, but congestions and lengthy cargo waiting times remain a concern. Rotterdam and Bremerhaven ports are seriously congested.

Local Rates – No Increase yet

Local Space – Tight

Local Capacity/Equipment – Limited

Note – Reservations should be made 4 weeks ahead of time

Latin America

One line status – With almost full capacity utilization, cargoes are full, and cargo rolling is likely.

Local Rates – Remains Soft

Local Space – Limited

Local Capacity/Equipment – Limited

Note – Reservations should be made 2-3 weeks ahead of time

Air Freight Market Updates July 2022 for the United Arab Emirates

Air Freight Demand – The demand curve tends to the positive. With the dominance and radical surge in e-commerce, faster and more frequent delivery has been invoked. Shippers have turned attention to air freight as an alternative to the alarming port congestions on different routes.

Carrier Capacity – capacity has been affected by airspace closure, especially in Europe due to the Russia-Ukraine conflict. Carrier capacity has also hit a down stride on the Chinese route due to the just-ended lockdown.

Local Rates – war surcharges, increasing fuel prices, and other key factors have triggered higher rates. The increased rate is expected to last for a while.

The Middle East and Air Carriers ME

Air freight is still on a recovery path as a reality of the post-pandemic era. From the beginning of the year to date, a steady improvement in cargo volume has been experienced compared to last year. A minimum increase of 7.2% has been registered compared to the previous year. Demands are expected to uptick in several routes and this pushes the demand on Air Freight carriers as an alternative to the disturbing port congestion across several regions.

Terminals are functioning and a little capacity reduction is possible.

Asia

The Asian market was greatly affected by the Shanghai lockdown, as they are key influencers. However, as the lockdown ends and production resumes massive activity is predicted on this route. Cargo volume is recovering and expected to shoot up more, but capacity may experience a few constraints. Rates have also increased across the Asian route.

Europe

There is a stable level of demand and capacity has experienced a reasonable improvement. Rates are reducing but a shoot in jet fuel price may influence the fuel surcharge in July. Booking to the uplift window is approximately 5 to 10 days but early booking is recommended.

North America and South America

Stable demand and capacity have been the order in America. Dwell times have been significantly reduced and rates have remained unchanged. However, fuel price continues to fluctuate.

Local Updates the United Arab Emirates, July 2022

Maersk launches its inaugural business summit in Dubai. High-level supply chain experts, prominent economists, and logistics experts were all featured at the summit. Read more

Scan Global Logistics further expands its foothold in UAE. Scan Global Logistics gains more grip in the UAE. Read more

DP world to invest further in Romania port. An agreement between Dubai’s port and the Romanian government has been signed to develop infrastructure at port Constanta. Read more

Product tanker rates soar to heights not seen since the start of the pandemic. The product tanker market continues to improve with all sectors meeting up to the standards before the pandemic in 2020. Read more

There will be no sailing from Jebel Ali, UAE to the Asian gulf on July 3, 10, and 24 2022. Hapag Lloyd freight update.

Factory Output News July 2022

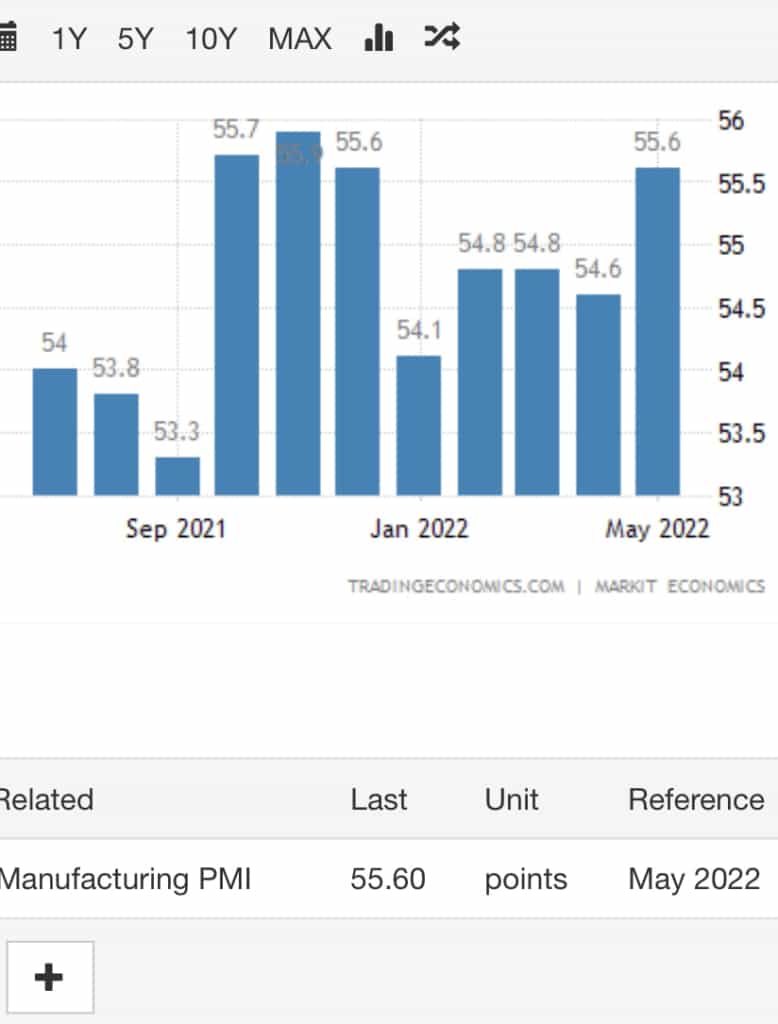

Middle East

A major uptrend in PMI since the start of 2022. The records of May 2022 made it a complete 5months of the most significant increase. There is an increase in both foreign and domestic demand, with employment and output also enjoying the increasing stride. Buying levels reduced, output charges reduced, while input cost inflation increased. Source- Markit Economics

Asia

The lockdown in Shanghai and other cities in China disrupted productivity across Asia. Japan, Malaysia, and Taiwan also reduced their productivity in connection to China and inflation issues. Demand has been crippled and the supply chain dented in the previous month. But the end of the lockdown kickstarts production activities and pushes Asian productivity to a positive curve.

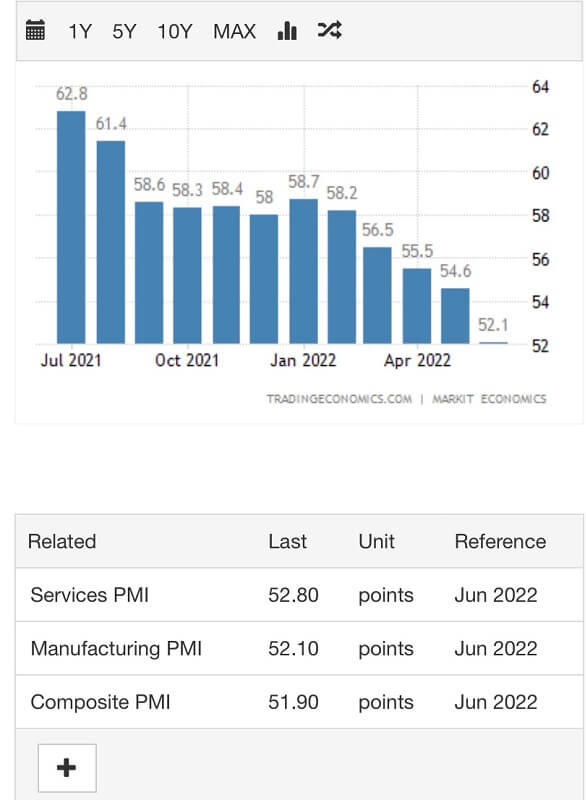

Europe

Manufacturing PMI in Europe dropped from 54.6 in May to 52.1 in June. It is the first fall in production recorded in the last two years. More attention was placed on unfilled orders as a result of a decline in exports and intake orders was experienced. Overall the demand dropped with the Ukraine- Russia conflict playing a part. Source- Markit Economics

America

A little push in the PMI was experienced in June. However, remains the slowest growth experienced since July 2020. Several supply chain disruptions and more focus on the utilization of current inputs for production. Inflationary pressures, rise in employment, and reduction in new orders all sum up American productivity.

This Month’s Eye-catching News

West Coast dockworkers fail to reach a labor agreement with port employers Read More Here

Brands to continue higher airfreight spending despite the added cost Read More Here

DB Schenker acquires USA truck for $435 Read More Here

Biden just signed a law to lower shipping costs. Will it work? Read More Here

Port Elizabeth car terminal’s record achievements Read More Here

Flood and load shedding weighs on the economy Read More Here

Borderlands: Tribal aims for Latin American SMBs using blockchain, crypto Read More Here

Delta airlines paying $10.5m for alleged cheating of postal service Read More Here

FedEx launches long-awaited operational integration Read More Here

Amazon cancels or delays plan for at least 16 warehouses this year Read More Here

Fashion and apparel lead the way in North American e-commerce sales Read More Here