Freight Market Update: Air & Ocean [February 2021]

Table of Contents

Freight Market Updates February 2021

The Topic of the Month

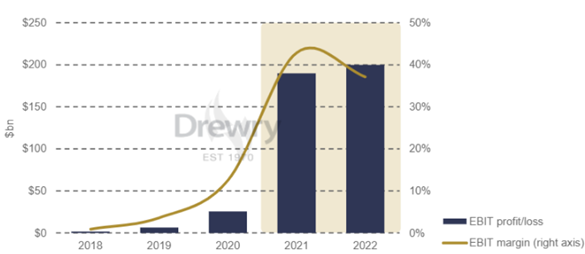

Profitability in Container Shipping is Expected to Reach New Stratospheric Highs in 2022.

According to Drewry’s latest Container Forecaster research, the sector’s EBIT in Q3 2021 was $70.9 billion, a “staggering nine-fold gain” over the previous year. Drewry has raised its prediction for the year to $190 billion from $150 billion earlier, and ocean carriers will have the third year of 15% or greater annual growth in overall revenue in 2022.

Carriers have yet to announce full-year 2021 financial results, but clogged supply chains and extremely high rate levels will keep the profit faucet running until 2022. Drewry’s EBIT projection for container shipping in 2022 is $200 billion, $10 billion more than in 2021, with a margin of 37%.

According to Drewry experts, the third quarter will most likely be the peak profit time for carriers in the current cycle, while the entire year 2022 will most certainly exceed 2021.

Ocean Freight Market Updates February 2022 United Arab Emirates

Outbound Ocean

Keys

| Sign | Meaning |

| ++ | Strong Increase |

| + | Moderate Increase |

| = | No Changes |

| – | Moderate Decline |

| — | Strong Decline |

ME – North America

One line status – Rates are higher. PSS/GRI is applied by all carriers. Space is limited. Bookings must be made 3-4 weeks in advance. Carriers are refusing to provide space for the West Coast of the United States owing to a lack of capacity at the transshipment port.

Local Rates – PSS/GRI are applied by all carriers (++)

Local Space – Extremely Critical (–)

Local Capacity/Equipment – Limited / Undercapacity (-)

Notes: Bookings need to be placed a month ago in advance.

ME – Europe

One line status – Rates remain high. Space must be reserved two weeks in advance. Lightweight cargo is preferred by carriers.

Local Rates – Rates remain at an all-time high. They have, however, remained constant throughout January 2022. Some slight increases already experienced for December in the lead-up to the Chinese New Year period and due to blank sailing schedules. (+)

Local Space – Critical (-)

Local CapacityEquipment – Available (-/=)

Notes: Take planning for a month

ME – Africa

One line status – Rates, GRI, and premium surcharges are all increasing. Space is only available for reservations made at least two weeks in advance. On most lanes, carriers are releasing bookings against “Sea Priority/Shipping Guarantee,” and carriers are less interested in 20′ equipment. Carriers’ allotment for outbound Ex- GCC is still complicated in South and West Africa. In East Africa, the space situation remains precarious. Space is only available for reservations made at least two weeks in advance. Carriers only release bookings with a premium charge (Sea Priority/Shipping Guarantee, for instance).

Local Rates – Prices are on a general higher (+)

Local Space – Critical and low for East Africa, while relevantly at ease for South and West Africa (-)

Local Capacity/Equipment – Available (+)

Notes: Only bookings made at least 2-3 weeks in advance

ME- Mediterranean MED

One line status – Rates are still rising. Space must be reserved two weeks in advance. Lightweight cargo is preferred by carriers.

Local Rates – Prices are on a general increase (+)

Local Space – Limited (-/=)

Local Capacity/ Equipment – Available

ME – ISC (Intra-Gulf)

One line status – Rates are increasing, and free time at the destination is reduced.

Local Rates – Price is on a general increase (+)

Local space – Available at premium level (-/=)

Local capacity/ Equipment – Limited (-)

Notes: Reservations must be made 2-3 weeks ahead to secure

ME – Far East Asia

One line status– Carriers prefer to relocate empty boxes rather than laden ones in order to decrease turnaround time. The amount of time spent at each destination is decreased.

Local Rates – Price is on a general increase (+)

Local Space – Available (=)

Local Capacity/Equipment – Available (=)

Notes: Reservations must be made 2-3 weeks ahead to secure

ME – China

One line status – Looking ahead to 2022, market conditions are expected to persist at least through Q1 – with significant demand around the Chinese New Year. The major public holiday in APAC is on February 1st, 2022, however. Covid-19(Omicron) has caused a port personnel shortage, which will have ramifications for the upcoming Holiday season.

Local Rates – Price are on a general increase (++)

Local Space – Extremely Critical (–)

Local Capacity/Equipment – Limited (-)

Notes: Reservations must be made 3-4 weeks ahead to secure

ME – Oceanic

One line status – Carriers are imposing weight restrictions per Twenty-foot Equivalent Unit, decreasing total capacity. Congestion at South East Asian transshipment ports is generating several weeks of transit delays. Spot rates are rising month over month.

Local Rates – (+)

Local Space – (-/=)

Local Capacity/Equipment – (-/=)

Notes: Reservations must be made at least 4 weeks ahead to secure

ME – Latin America

One line status –Due to insufficient capacity, most carriers are not accepting bookings. The situation is likely to endure until the end of the first quarter of 2022.

Local Rates – Prices are on a general increase (++)

Local Space – Very tight (–)

Local Capacity/Equipment – Available (-/=)

Notes: Reservations must be made at least 4 weeks ahead to secure

Inbound Ocean Market Update for the United Arab Emirates

North America

One line status – Several services are being impacted by structural port omissions in Savannah and Jeddah, resulting in a space constraint and capacity decrease. After over a quarter and a half of steady rates, we are starting to see GRIs return to the market, most likely in preparation for this year’s earlier-than-usual Ramadan holidays.

Local Rates – Rates have been increased in January 2022. (=/+)

Local Space – Critical (-)

Local Capacity/Equipment – Availability for standard equipment at ports has not been an issue, but any special equipment is hard to come by. (-/=)

Notes: Place bookings 2-3 weeks in advance to secure your equipment, trucking, and vessel space.

AsiaPacific

One line status – Early factory closures from China as early as 23 January, as well as Lunar New Year (LNY) vacations in China till mid-February, will result in reduced overall cargo demand, resulting in more blank sailings anticipated in February. Recent Covid-19 breakouts in China will have a much greater impact on congestion and schedule dependability. Furthermore, feeder/equipment restrictions in South East Asia remain significant. Overall equipment shortages in Asia are becoming common, particularly for 40’HCs. The general consensus is that short-term interest rates will be raised from January until the first half of February.

Local Rates – Increased (+)

Local Space – Available (-/=)

Local Capacity/Equipment – Under Capacity (-)

Notes: Book 3-4 week before

Europe

One line status – Rates have softened slightly depending on the service and alliance, there is a shortage of empties due to CNY blanks, and there is congestion in MED hubs. Space will continue to be limited. Increased demand, particularly for IPBC. Rates have mainly been extended.

Local Rates – Rate slight increase (+/=)

Local Space – Critical (-/=)

Local Capacity/Equipment– (=)

Notes: Book 2-3 weeks before. Shortage of 20’ft containers

Latin America

One line status –The region has been plagued by structural service changes, port omissions, equipment shortages, and local labor strikes.

Local Rates – Rate increase (+)

Local Space – Critical (-)

Local Capacity/Equipment – (-/=)

Notes: Book 2-3 weeks before

Indian SubContinent (ISC)

One line status – Empty equipment and uneven or blanked sailing schedules will continue to be an issue for ISC exporters shortly.

Local Rates – Rate increase (+)

Local Space – Critical (-/=)

Local Capacity/Equipment – Limited (-)

Notes: Book 2 weeks ago, Shortage of 20’ft containers

North Africa

One line status – Vessels have the capacity, and carriers are ready to take on more cargo. There is a major shortage of 20′ containers from North Africa.

Local Rates – Rate increase (+)

Local Space – Critical (-)

Local Capacity/Equipment – Limited (-)

Notes: Book 2 weeks ago, Severe Shortage of 20’ft containers

Air Freight Market Updates February 2022 for the United Arab Emirates

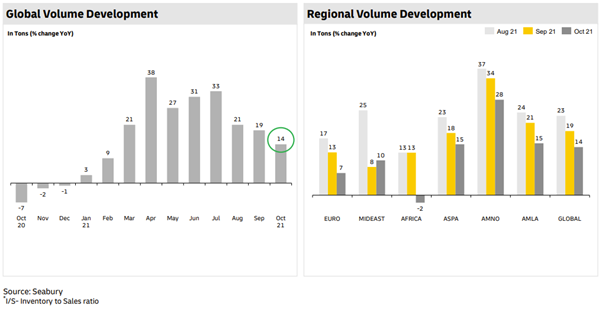

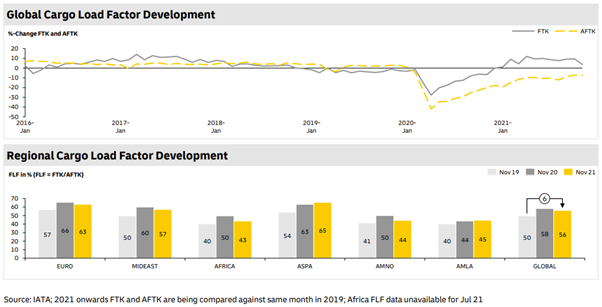

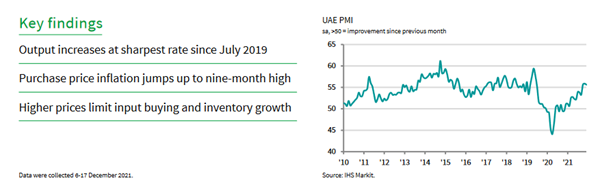

Air Freight Demand – The rise in demand is still spreading across various sectors, and cargo demand is expected to remain strong in the face of new tech product releases and the forthcoming Lunar New Year. Economic recovery and GDP growth of 4% or more in 2022 are projected, and demand is likely to continue robust, resulting in inventory filling.

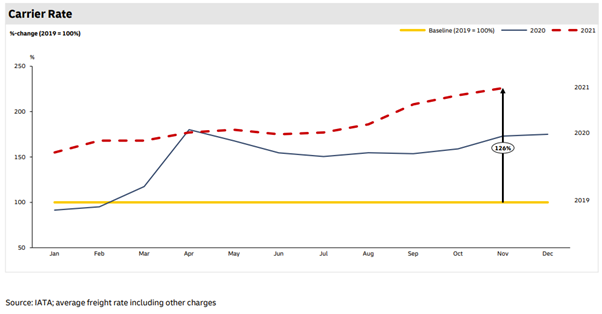

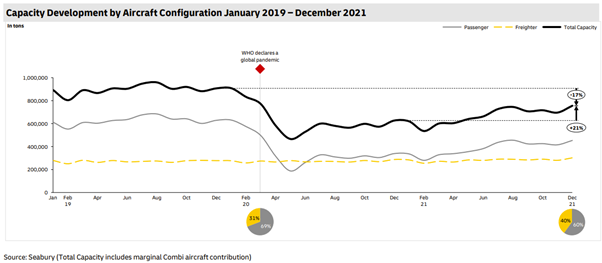

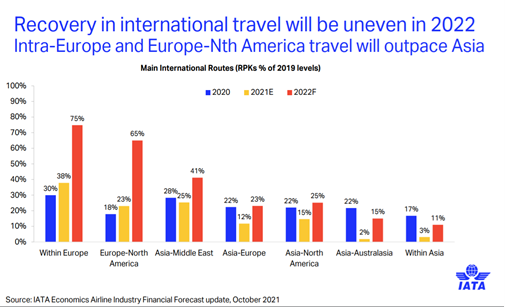

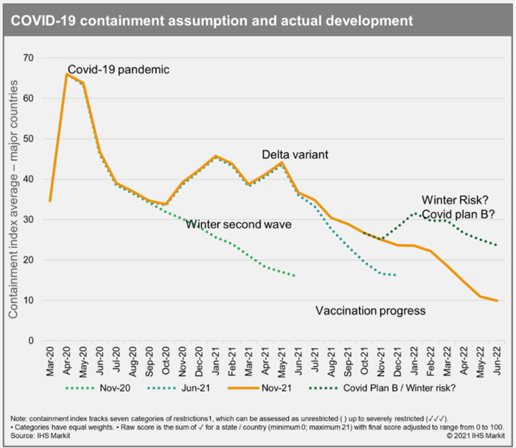

Carrier Capacity – Capacity recovery is sluggish and will continue to be constrained. PAX (Passenger Aircraft ) resumption on some Tradelanes; increase in belly capacity; flight cancellations will have an impact on the recovery. Increased freighter capacity is projected. • Belly capacity improved marginally as vaccinations increased, although it is still -28 percent lower than pre-COVID levels.

Local Rates -Rates for guaranteed access to capacity are projected to remain expensive in comparison to previous years, with ocean congestion and flight cancellations exacerbating the issue. The emergence of new variants of Covid adds to the volatility of the market. In November 2021, rates remained +126 percent higher than the 2019 baseline and +30 percent higher than the higher 2020 baseline.

The Middle East and Air Carriers ME

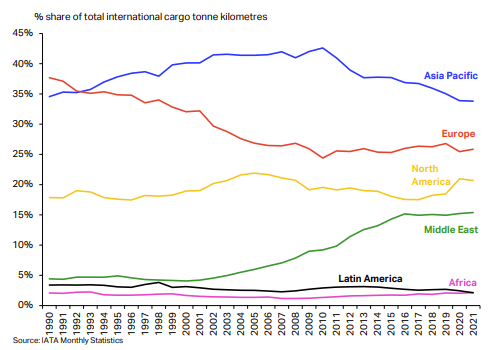

International cargo volumes of Middle Eastern carriers increased by 5.7 percent in December 2021 compared to December 2019. Growth slowed at the end of the year, owing in part to a decline in volumes on the vital Middle East-Asia route. Overall, foreign Cargo Tonnes Kilograms (CTKs) were 10.6 percent higher in 2021 than in 2019, providing the region a modest increase in market share.

This month, Qatar Airways Cargo will begin insourcing its operations in Spain, which were previously managed by ATC Aviation Services. The airline claims it intends to retain all current regular flights while adding some new routes, with online booking accessible through WebCargo by Freightos.

Asia

China: More difficult COVID-19 restrictions and preparations for the Beijing Winter Olympics are making it difficult for airfreight shipments just as shippers are entering the pre-Chinese New Year high season.

Trans-Pacific East Bound (TPEB) flights are still being canceled as a result of positive Covid cases, but demand is gradually increasing before Lunar New Year (LNY), causing rates to rise. Far East Westbound (FEWB) rates continue to fall as demand in South China remains relatively low.

In the run-up to Lunar New Year, demand is increasing. Capacity is nearly full, and TPEB charges have risen. Based on current market supplies, this trend is anticipated to continue through the LNY vacation in North China.

Many passenger flights have been canceled in Hong Kong, while Cathay Pacific’s air cargo flight schedule has been reduced to about 20% of its regular levels in Q1.

In Taiwan, the market remains steady, with no substantial changes in rates or capacity before Lunar New Year (LNY). The largest capacity restrictions are at SFO and ORD, but other destinations are still acceptable.

Europe

For the moment, capacity remains steady, with carriers infusing intra-Europe schedules to feed Transatlantic flights. If the lead time allows, a deferred option might be quite suited, offering rates lower than the typical market level.

The Istanbul airport was temporarily closed owing to heavy snowfall. Manage expectations if transporting cargo from this location, however, there has been little impact on freight flow so yet.

As we approach the end of January, demand is constant. Rates on the West Coast of the United States have risen somewhat, but overall rates remain constant. Congestion is manageable in important EU export hubs.

maximized in this case. There has been no news of congestion at Europe’s main export hubs.

North America & Latin America

The terminals at LAX/ORD/JFK have decreased the inbound backlog cargo marginally, which has a positive impact on the export side.

Larger shipments from major outbound gateways might take 2 to 3 days from the time they are booked to the time they are picked up.

Omicron has caused some local and international flight cancellations and/or delays in the United States.

To satisfy throughput timings and screening requirements, most terminals have reduced free time for storage and early close-outs for exports.

During the second half of January, US export demand gradually increased. Capacity may be managed.

Rates to Latin America, Europe, and Asia are marginally higher than in the first two weeks of January.

Local Updates the United Arab Emirates, February 2022

Logistics News February 2022

ESL has implemented an Environmental Fuel Surcharge (EFS), effective from March 1st, 2022, based on a Low Sulphur fuel price of between US$650 to US$700 per ton. Read More Here

MSC will be implemented late D/O collection fee, Effective from 1st February 2022. Read More Here

Maersk offers the broadest coverage and competitive transit times at unmatched reliability, effective February 1st, 2022, that will proceed and cancel any booking booked through SSIB aging 15 days and above with no container(s) linked to it to free up space allowing the opportunity to more customers to book, materialize and load their shipments with them. Read More Here

CMA CGA has implemented Peak Season Surcharges (PSS03), Effective from February 15th, 2022, for cargo from Middle East Gulf, Red Sea to USEC + USGC + Canada East Coast. Read More Here

CMA CGA has advised that Any new booking under Carrier Haulage to or from Mali are suspended until further notice, Due to restrictions imposed by the ECOWAS (Economic Community of West African States) against Mali. Read More Here

ESL has updated custom advisory for East Africa ports, find the latest port and service update Read more here

Hamburg Sud has implemented Demurrage and Detention Rates (DND) to the United Arab Emir, Effective from March 1st, 2022 those demurrage & detention rates will be applicable for imports to UAE Expiry. Read More Here

CGA CGM Has implemented Overweight Surcharge (OWS), Effective from February 15th, 2022, on dry cargo from West Med, Black Sea, Adriatic & East Med to northwest India & Pakistan. Read More Here

ESL has implemented General Rate Increase (GRI), effective from February 16th, 2022, In order to continue providing high-quality service from the Middle East to Mombasa, Kenya, and Dar Es Salaam, Tanzania. Read More Here

Factory Output News February 2022

Financials overtook Healthcare to take the top place in the worldwide sector output ranking in December. Consumer Services was the lowest-performing industry, despite a global increase of COVID-19 cases.

America

North America, the Middle East, and Africa witnessed double-digit growth during 2019, while Europe saw more modest growth and the Asia Pacific stayed relatively steady.

Latin America‘s volume remained lower than in 2019. Total market capacity was 10.9 percent lower than in 2019.

Experts have warned that heightened tensions between Russia and Ukraine might increase marine bunker fuel prices, placing a further burden on carriers.

Asia

Non-oil exports from Singapore increased by 18.4 percent in December, making 2021 the strongest year since 2010. Electronics and medicines demand aided shipping growth. With the growth of Omicron cases and China’s zero covid policy, exports to China are expected to halt.

Cambodia A bilateral free trade agreement (FTA) between Cambodia and Korea is likely to enter into force early this year, opening up additional markets for Cambodian goods and attracting more investment for exports.

In response to rising demand, Vietnam BW Industrial is expanding and strengthening its capacity to service export producers in the Bac Tien Phong Industrial Zone.

China‘s soybean imports began to recover from the African Swine Fever (ASF) in 2019, and soybean imports are expected to be 10% higher in 2021/22 than in 2017/18. With fewer grain and soybean imports from the United States in the fourth quarter of 2021, a better Brazilian grain season is forecast in early 2022.

According to the IHS Markit Flash U.S. Manufacturing PMI, US manufacturing growth decreased for the sixth consecutive month in January. New order growth has dropped to its worst rate since July 2020, with manufacturers reporting that clients have cut down on spending due to cost rises.

This Month’s Eye-catching News

Intra-Asia and Africa trades lose out in today’s record-breaking box shipping era Read More Here

The Global Rail Freight Market is expected to grow by $ 29.29 bn during 2022-2026. Read More Here

Ningbo Containerized Freight Index remains stable in January 2022. Read More Here

Global freight rates move up on container shortage, traffic congestion at major ports. Read More here

Elevated freight rates are likely to remain through much of this year because of market turmoil, according to experts. Read More Here

Businesses may want to sign 2- or 3-year contracts to hedge against future price increases says the head of DHL’s freight business. Read More Here

Airfreight rates out of China to the US and Europe have plummeted after December’s record holiday season. Read More Here

Lufthansa Cargo is the latest carrier to suffer operationally from an outbreak of Covid and has been forced to cancel all transit traffic through Frankfurt. Read More Here

The container shipping sector looks set to continue its extraordinary profitability cycle in 2022. Read More Here

Soaring inflation, tightening cargo capacity, and a shrinking labor market only add up to one thing for today’s global logistics managers: the triple whammy. Read More Here

Shipping line profits at full steam as trade chaos shows little sign of abating. Read More Here

Disruptions in China can lead to ‘ripple effects’ across the global supply chain, says HSBC. Read More Here