Freight Market Update: Air & Ocean [August 2021]

Table of Contents

Freight Market Updates August 2021

The Topic of the Month

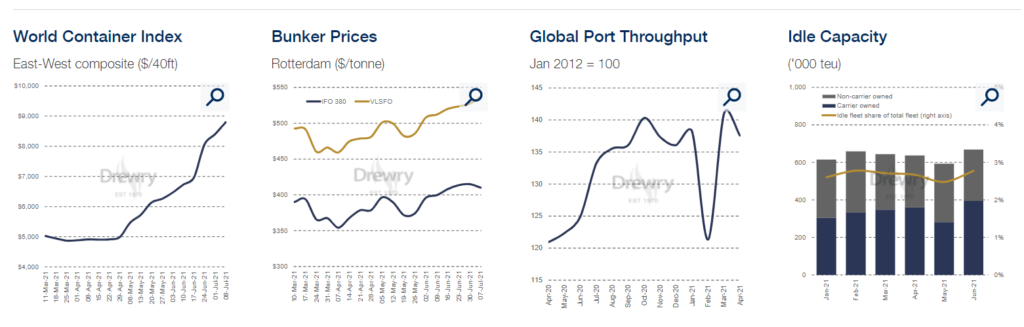

On one side August can really be labeled at best as a “Month of Doubts & Disruption” for the Shippers, suppliers, and consignees. Shippers are struggling to explain high rates and poor service.

While on the other Ocean carriers are enjoying their best 1H in many many years and it is not about to subside anytime soon.

With Ocean carrier heading into what is normally the “Traditional Peak Season” cargo, the market is showing no signs of slowing down.

On the disruption side, we have typhoons hampering port operations in Shanghai and Ningbo, soaring demand, a shortage of containers, saturated ports, and too few ships and dock workers, all are contributing towards a squeeze on the transportation capacity whilst resulting in the higher freight cost. To top it off we have a recent outbreak in Covid delta variant in Asian export hubs like China that have made matter worse.

Keys

| Sign | Meaning |

| ++ | Strong Increase |

| + | Moderate Increase |

| = | No Changes |

| – | Moderate Decline |

| — | Strong Decline |

Ocean Freight Market Updates United Arab Emirates

Outbound Ocean

ME – North America

One line Status: Rates have cooled down a little with just a moderate increase in price. PSS/GRI has been applied by most of the carriers as noticed in July.

Local Rates – Moderate increase from July 2021, GRI will be implemented by Hapag on 1st of September (++)

Effective July 19, 2021, Hapag Lloyd implement HLC in the USA and Canada

Local Space – Limited (-)

Local Capacity/Equipment – Limited but available on selected carrier (-)

Notes: Reservations must be made 2-3 weeks ahead of time

ME – Europe

One line Status: Rates increasing, space is limited, and only premium rates are available. Carriers like light-weight cargo.

Local Rates – No increase from July 2021 (++)

- Effective September 1st, 2021 till September 14, 2021, Hapag Lloyd announced Tariff Rates to North Europe from ISC

- Effective September 1st, 2021, CMA CGM announced Freight All Kind (FAK) rates from MiddleEast to North Europe

Local Space – reduced from July 2021 (–)

Local CapacityEquipment – equipment is available but bookings are limited but available on a selected carrier at a premium (-)

Notes: Reservations must be made weeks ahead to secure

ME – Africa

One line status – Bookings for West Africa are only released against “Sea Priority / Shipping guarantee on most lanes in Africa, Space is only available for bookings made at least 3-4 weeks in advance. Carriers have reduced their allocation ex GCC. The situation seems stable with GRI implemented by carriers for East Africa

Local Rates – Prices are on a general increase (+)

- Effective August 15, 2021, Hapag Lloyd will implement GRI to East Africa from UAE

- Effective August 15, 2021, CMA CGM will implement PSS to North Africa from UAE

- Effective August 1st, 2021, CMA CGM will implement BRAF to West Africa from UAE

Local Space – Critical and low for West Africa, relevantly at ease for East Africa (-)

Local Capacity/Equipment – available (-)

Notes – Maersk Spot for 2 weeks in advance and Priority is given to cargo utilizing “Shipping Guarantee” cargo

ME- Mediterranean MED

One line Status – Rates are increasing, space is limited and only available to premium rate level cargo.

Local Rates – Prices are on a general increase (+)

- Effective September 1st, 2021 till September 14, 2021, Hapag Lloyd announced Tariff Rates to the Mediterranean from MiddleEast

- Effective September 1st, 2021, CMA CGM announced Freight All Kind (FAK) rates from MiddleEast to East Mediterranean

Local Space – Limited but at a premium (-)

Local Capacity/ Equipment – Available

ME – ISC (Intra Gulf Service)

One line Status — Equipment availability is steady and rates are stable as compared to July 2021 to escalate.

Local Rates – Price are on a general increase (+)

Local space – available (-/=)

Local capacity/ Equipment – available

ME – Far East Asia

One line status– Costs have risen, owing to a lack of equipment for goods heading for Asia. To decrease turnaround time, carriers prefer to relocate empty boxes rather than loaded boxes. Free time at the destination has been reduced.

Local Rates – Price are on a general increase (++)

Local Space – Tight Space (–)

Local Capacity/Equipment – available (=)

ME – China

One line status – Costs have risen, owing to a lack of equipment for goods heading for Asia. To decrease turnaround time, carriers prefer to relocate empty boxes rather than loaded boxes. Free time at the destination has been reduced.

Local Rates – Price are on a general increase (++)

Local Space – Tight Space (-)

Local Capacity/Equipment – available (=)

ME – Oceanic

One line status – From United Arab Emirates Prices are elevated

Local Rates – (+)

Local Space – (-)

Local Capacity/Equipment – (=)

ME – Latin America

One line status – No carriers accepting bookings as the sector due to limited allocation. The situation is expected to remain the same as previously in July 2021.

Local Rates- Prices are on a general increase (++)

- Effective August 15th, 2021, Hapag Lloyd implement GRI East Coast of South America

Local Space – Very tight (–)

Local Capacity/Equipment – (=)

Inbound Ocean market update the United Arab Emirates

North America

One line status – The US West Coast continues to experience delays in LA while both Oakland and Seattle have seen schedule delays and bunched-up sailings worsen in recent weeks.

Local Rates – One carrier announced GRI for Mid Augusts, while others are aiming for the first week of August.

Local Space – Tight from US West Coast. The US East Coast is showing signs of improvements in available spaces. In the US Gulf space has increased with capacity more readily available

Local Capacity/Equipment – Capacity tightest from the US West Coast. Equipment and chassis are tight at most ports and all ramps.

Notes – Book 4+ weeks out.

AsiaPacific

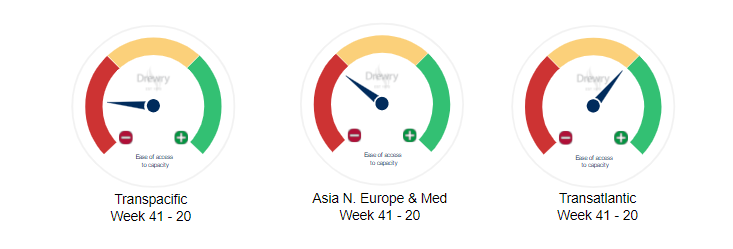

One line Status – Rates generally continue to trend upwards as demand remains strong. The absence of fresh capacity release from schedule and congestion delays creates persistent tension on space.

Local Rates – moderate increase (+)

Local Space – Critical (-)

Local Capacity/Equipment – Under capacity (-)

Europe

One line status – Space seems tight throughout August with additional blank sailings and this trend seems to creep well into September and October.

Local Rates – Rate slight increase (+)

Local Space-– Super tight (–)

Local Capacity/Equipment- (–) but will get better in mid-August

Latin America

One line status – Tight space, equipment situation, and structural service changes leading to increases in Q3. Challenges: Protests in Columbia waned towards the end of July, but the effects on an already strained market will continue to be felt. The port strike/closure in Durban disrupts already fragile schedule integrity.

Local Rates – Rate increase (+)

Local Space – Super tight (–)

Local Capacity/Equipment – (=)

Indian SubContinent (ISC)

One line status– Carriers are adding blank sailing in order to re-align schedules. Equipment is an issue across India as inland container depots are also facing critical shortages

Local Rates– Rate increase (+)

- Effective August 18, 2021, Hapag Lloyd will implement GRI in the Middle East from India

- Effective September 1st, 2021 till September 14, 2021, Hapag Lloyd announced Tariff Rates to the Mediterranean from ISC

- Effective September 1st, 2021 till September 14, 2021, Hapag Lloyd announced Tariff Rates to North Europe from ISC

- Effective August 24, 2021, Hapag Lloyd will implement GRI in the Middle East from Mundra, India

Local Space—Critical (-)

Local Capacity/Equipment – (=)

Air Freight Market Updates for United Arab Emirates

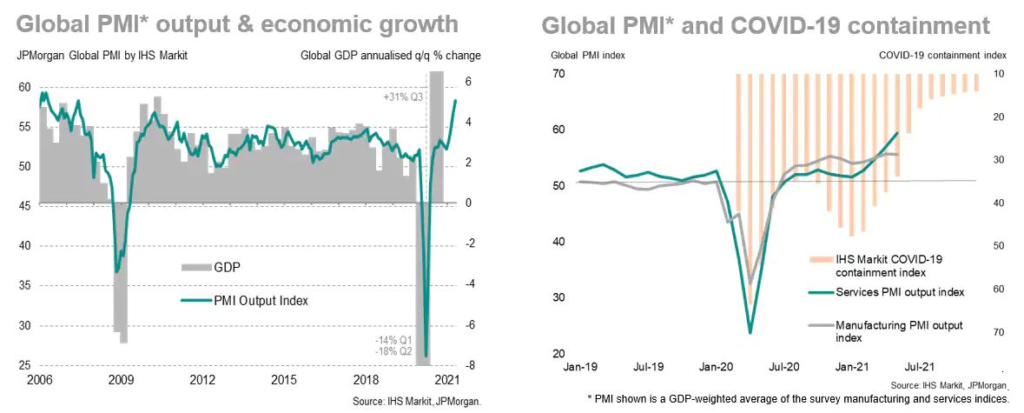

Air Freight Demand – demand surge still spread across various sectors from hi-tech, high-value shipment to pharma. Ecommerce has also contributed to solid demand. Port Congestions, extremely high ocean rates on the east-west trade, and urgent seasonal inventory restocking continue to convert previously ocean-reliant cargo to air. The healthy PMI index still projects sustainable air cargo demand growth going forward.

Carrier Capacity – The increase in capacity appears to be much slower than the demand, and therefore rates and load factors are expected to remain high in the short term. The latest wave of COVID restrictions in Europe and across other regions could potentially affect the market’s speed of recovery in 2021 as capacity is restricted. A return to pre-pandemic capacity is not feasible in the short term.

Local Rates – Freight rates increased further up from May 2021 even though May 2021 has seen +80% higher air freight rates as compared to May 2019 and +7% higher than the high of May 2020.

Middle East and Air Carriers ME

Some flight restrictions to impacted regions have been imposed in the United Arab Emirates. The operation of freighters and Pax cargo flights is limited due to capacity constraints. Terminals are functioning regularly for cargo, but with a reduction in staff, which has a detrimental effect on efficiency. In KSA, no passenger planes are permitted to arrive or depart. Except in the case of belly passengers for freight.

Carriers based in the Middle East posted a 17.1% increase in their international air cargo volumes in June 2021 vs June 2019, boosted by strong performance on the ME-Asia and ME-Nth Am trade lanes

Asia

The effect of Typhoon In-Fa has caused the PVG TPEB airfreight market rate in August 2021 to rise slightly. Market rates are comparable to last week in the remaining lanes and other significant origins like HKG and TPE.

The rest of Asia’s market circumstances differ from country to country, and from city to city. Two countries act as effective examples. Because of Samsung, HAN space in Vietnam is limited, and SGN is still under lockdown. MAA has been put on lockdown in India, whereas DEL has resumed production.

Europe

Terminals in the United Kingdom are functioning regularly for cargo, but with less staff, which is affecting efficiency. Passenger flight restrictions are widespread; freighters are flying normally, although capacity is limited. Turkey’s economy has slowed dramatically. In terms of general business, the Izmir office has been severely hit. Terminals are running regularly for cargo – only PAX flights have been disrupted. There is enough capacity in the market to meet this demand; expect a PAX injection from the UK, which will open its borders to fully vaccinated US/EU visitors.

North America & South America

In Los Angeles and Houston, freighters are flying normally, although capacity is limited. Restricted operations affecting freight planes in Miami. Only PAX flights were disrupted; cargo terminals remain normal in San Diego.

While no significant capacity is built, export demand from the United States remains fairly constant and consistent. Large shipments from all major export gateways in the United States may take 2-3 days to uplift into major European destinations from the time they are booked Due to insufficient capacity, the majority of airlines are refusing to take bookings. In the mid-term, the situation is anticipated to stay unchanged in Latin America.

Local United Arab Emirates, August 2021

Revised Detention and Demurrage from the 1st Sep 2021 by CMA. Revised detention and demurrage for Export and Import shipment applicable from 1st September 2021 for DRY & NOR, Reefer, Special Equipments, and HAZ Containers. Read more here

Revised Demurrage from the 1st Sep 2021 by MSC, Revise Demurrage Charges for all shipments applicable from 1st September 2021 into Jebel Ali, Ajman, Fujairah, Sharjah, Khorfakkan, Ras Al Khaimah, and Umm Al Quwain ports. Read More

Maersk announced a network upgrade for Europe, the Middle East, and the Indian Subcontinent, which will take place in late July and early August. Maersk is extending its direct coverage between the Indian Subcontinent and the Middle East with Europe.(Source: DHL Market updates)

Hapag Lloyd has updated their AED and USD account details effective August 08, 2021 Read more here

CMA CGM has enhanced its service delivery with the introduction of Online Electronic Delivery orders. This can be facilitated through CGMA CGM “MyCSO” Option. Read more here

Automation of DAFZA Gate Pass. DAFZA is implementing Freezone’s new automated gate pass system, DAFZA-WAY, which successfully launched on 27th June 2021. You can reach DAFZA’s Call Centre on 600532392 for any inquiries

Dnata enhances services. Starting from July 1st, 2021 cargo operations at DXB will now function around the clock 24/7. Slot request functionality has been enhanced as well. Read more here

Hapag Lloyd UAE is enhancing its booking portal with Smart Web Booking starting August 1, 2021. This tool will enhance response time, availability, and certainty for the user. (Source Hapag Llyod)

Weight Deviation Fee (FIO) by Hapag Lloyd, Effective July 27, 2021, Hapag will introduce a Weight Deviation fee for the weight over 3 tons for all cargo originating from UAE / Pakistan / Kuwait / Bahrain / Qatar. Read more here

Effective August 1, 2021, Hapag Lloyd has applied fees and regulations in connection with cargo misdeclaration for all bookings (excluding LCL) from China, Hong Kong, and Taiwan Read More

Bunker Recovery Adjustment Factor(BRAF) by CMA CGM, Effective August 1st, 2021 CMA CGM announced the BRAF amount from the Indian Subcontinent and Middle East Gulf to West Africa. Read More

Freight All Kinds(FAK)

CMA CGM announced Freight All Kinds(FAK) rates, applicable September 1st, 2021 From the Middle East Gulf to North Europe and East Med. Read More

CMA CGM announced Freight All Kinds(FAK) rates, applicable September 1st, 2021 from Pakistan to North Europe, the Mediterranean, and North Africa. Read More

CMA CGM announced Freight All Kinds(FAK) rates, applicable September 1st, 2021 from Middle East Gulf to North European, Scandinavian & Polish, and East Mediterranean Trades (W/B). Read More

GRI (General Rate Increase) to USA CANADA

Hapag Lloyd has increased General Rate Increase (GRI) applicable from 1st September 2021 for Indian Subcontinent (ISC) and the Middle East to the USA and Canada Read More

GRI (General Rate Increase) to East Africa

Hapag Lloyd has increased General Rate Increase (GRI) applicable from 15th August 2021 from the Arabian Gulf to East Africa Read More

GRI (General Rate Increase) to South America

Hapag Lloyd has increased General Rate Increase (GRI) applicable from 9th August 2021 from East Asia to the East Coast of South America Read More

GRI (General Rate Increase) to/from the Middle East

Hapag Lloyd has increased General Rate Increase(GRI) applicable from August 18, 2021, From Sheva and Mundra, India to the Middle East. Read More

Hapag Lloyd has increased General Rate Increase (GRI) applicable from 15th August 2021 from the Middle East and ISC to the East Coast of South Africa. Read More

Hapag Lloyd has increased General Rate Increase (GRI) applicable from 24th August 2021 from the Mundra, India to the Middle East. Read More

PSS (Peak Season Surcharge) to North Europe

CMA CGM announced Peak Season Surcharges(PSS) applicable from 15th August 2021 from Middle East Gulf to North European Scandinavian & Polish, Baltic, West Mediterranean & Adriatic, East Mediterranean, Black Sea, North African, and Moroccan Trades (W/B).

CMA CGM announced Peak Season Surcharges(PSS) cargo from Pakistan to North Europe and the Mediterranean applicable from August 16, 2021. Read More

Overweight Surcharge (OWS) To North America

CMA CGM has made OWS effective on August 1, 2021, all cargo from/via Indian Subcontinent, Middle East Gulf, Red Sea, and Egypt ports of load and Origin TO/Destination U.S. East Coast ports, U.S. Gulf Coast ports, Canada East Coast and all inland destinations reached via above ports. When container gross weight exceeds 20 metric tons (cargo weight + tare) overweight freight additional.

Effective July 19, 2021, Hapag Lloyd will implement HLC (Heavy Lift Surcharge) from Indian Subcontinent & Middle East to the USA and Canada and will be applicable for cargo (+ tara) exceeding a weight of 18 tons. The Heavy Lift Surcharge (HLC) will apply for all 20’ dry, reefer, non-operating reefer, tank, flat rack, and open-top containers that have a payload above 18MTs.

Applicable origins: Indian subcontinent: India, Bangladesh, Pakistan, and Sri Lanka. Middle East: UAE, Qatar, Bahrain, Oman, Kuwait, Saudi Arabia, Jordan, and Iraq

Emergency Intermodal Surcharge (EIS) to North America

Effective August 20, 2021, CMA CGM announced Emergency Intermodal Surcharge for World to/from the USA. It allows for managing escalating costs to continue to provide a proper level of service. Read More

Tariff Rates by Hapag Llyod

Effective August 15, 2021, Hapag Lloyd announced Tariff Rates or all cargo for 20’ and 40’ General Purpose (incl. High Cube Container) from the Middle East and Pakistan to Mediterranean Read More

Effective September 1st, 2021 till September 14, 2021, Hapag Llyod announced Tariff Rates for all cargo transported in 20’ and 40’ General Purpose Containers (incl. High Cube Container) from Indian Subcontinent to the Mediterranean. Read More

Effective September 1st, 2021 till September 14, 2021, Hapag Llyod announced Tariff Rates for all cargo transported in 20’ and 40’ General Purpose Containers (incl. High Cube Container) from MiddleEast and Pakistan to the Mediterranean. Read More

Environmental Fuel Fee (EFF) Conclusion – MAERSK

Effective September 1 2021 MAERSK announced a renew of Environmental Fuel Fee (EFF) Read More

Factory Output News August 2021

Middle East

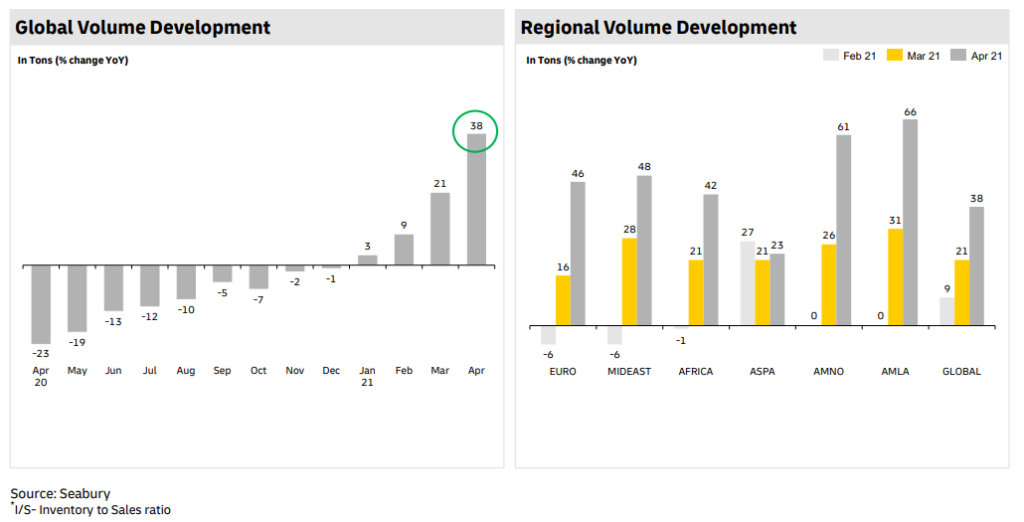

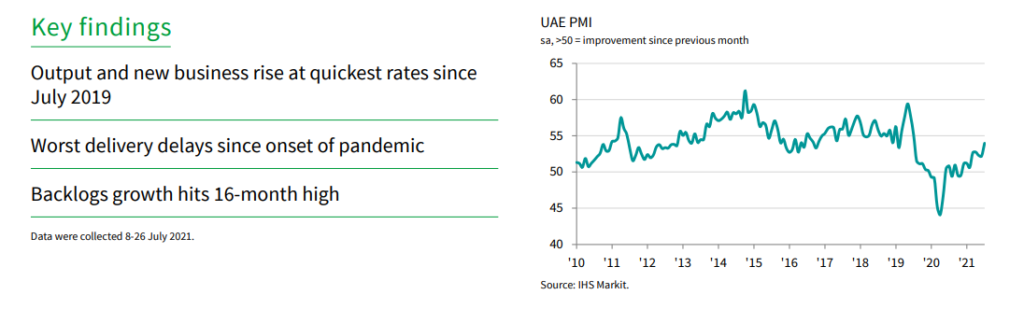

The rate of growth in the UAE non-oil economy picked up in July, reaching the strongest in exactly two years as demand continued to rebound from the COVID-19 pandemic. A sharp rise in new orders drove increasing pressure on business capacity and a marked expansion in output, while employment rose at the fastest rate since January 2019. Meanwhile, delays of shipments from Asia led to the worst lengthening of suppliers’ delivery times since April 2020 and contributed to a quicker rise in input costs (Source: IHS Markit UAE PMI)

Draft reference (9090d7afb6ce436fb3e2e4afffdab0b9 (markiteconomics.com))

Petro Chemical Demand hikes up during the tense time of high freight rates and Container supply which is Tight… (source)

Asia

New COVID-19 waves are wreaking havoc on the regional economy. Many nations, including IndonesiandVietnam, Singapore, Malaysia, Thailand, Cambodia, and Myanmar, have reimposed lockdowns due to the spread of the virus’s highly transmissible Delta form.

Global manufacturing supply chains are being disrupted by the crisis in Asia, with shortages and longer delivery delays contributing to inflationary pressures. LCDs, phones, copper goods, rice, and palm oil are among the products affected, in addition to semiconductors and integrated circuits. (source: DHL)

Europe

Western Europe’s corporate outlook is enhanced by a strong comeback in consumer spending. Leading signs point to a rapid increase in economic activity in Western Europe, as consumer-facing services gain from a substantial removal of COVID-19 restraints.

Lockdowns had a financial impact on consumer spending, but they will now be the driving force behind the recovery. Pent-up demand for services and non-essential products will be supported by improving labor markets and household savings amassed during the epidemic. Increased corporate confidence in the eurozone indicates a comeback in equipment investment, while construction investment continues to exceed. (Source: DHL)

America

In 2021, the US outlook predicts slower growth and greater inflation. The US real GDP growth projection for 2021 has been cut down from 7.4 percent to 6.6 percent in the June forecast. Poorer consumer and business expenditure in May, as well as a change in some government expenditure to recent quarters, are primarily to blame for the adjustment.

Due to a nearly complete end of pandemic containment measures, expansionary fiscal and monetary policies, and restocking of depleted stocks, the recovery is still on strong ground. As the economy returns to its pre-pandemic pace, the unemployment rate is anticipated to decline from 5.9% in June to 3.5 percent in mid-2023, despite record vacancy.

This Month’s Eye-catching News

Shipping Turmoil Threatens Coffee From World’s Biggest Grower Brazil

Amazone to Develop Air Cargo Facility at Newark Airport

Air Cargo Posts Strongest First Half-Year Growth Since 2017

Turkish Cargo becomes World third largest Cargo Airline in Jun 2021

Sirlank received only 2429 tourists in Jul 2021

Global demand isn’t booming. So why are shipping rates this high?

Battery-powered jets to handle middle-mile deliveries for parcel network

Logistics – the cornerstone of MENA’s fast-growing e-commerce market

Box volume growth outpacing terminal development – Lloyd’s Loading List (lloydsloadinglist.com)

Shipping crisis strikes Black Friday shopping amid Europe, China floods (cnbc.com)

Pet food shortages leave owners on the hunt for kibble and cat treats | Reuters

15-minute grocery delivery services are trying to compete with Amazon and DoorDash (modernretail.co)

Updated: FDA grants industry 30-day extension to comment on track and trace guidance | RAPS

ASEAN supply chains disrupted as delta variant surges – Nikkei Asia

Amazon faces more than slowing sales growth: it needs more warehouses | Reuters

Walmart To Offer Technologies and Capabilities To Help Other Businesses Navigate Their Own Digital Transformation

Cyber attack disrupts major South African port operations | Reuters

Air Products and Cummins to Accelerate Development and Deployment of Hydrogen Fuel Cell Trucks

FDA’s Budget: Medical Device Supply Chain and Shortages Prevention Program | FDA

Shipping Delays and Higher Rates Get Small Businesses Jammed Up – WSJ

Alibaba Challenges Amazon With a Promise: Fast Global Shipping (wsj.com)

Container Shipping Prices Skyrocket as Rush to Move Goods Picks Up – WSJ

Joe Lonsdale’s 8VC partners with cold storage giant Lineage Logistics (cnbc.com)