Analysis: Food tech should not look at food, but at their logistics to solve last-mile

Image Source: Lovindubai.com

Has anyone heard about the notion that food delivery is less about food and more about logistics.

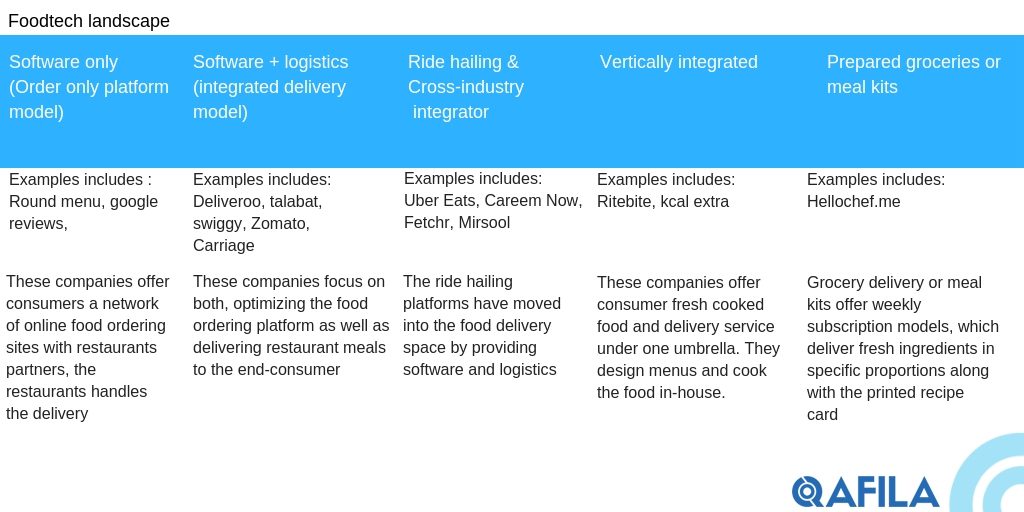

The Foodtech scene is heating up as more and more players are jumping into the last mile of the food delivery. A scene that was once limited to just those cafeteria delivery boys with just a phone call away, is now filled with incumbent tapping on the complex food supply chain jostle for a larger slice of UAE food tech pie and in the process conquer the greater GCC market.

Major Food tech players like Deliveroo, Zomato, Talabat, UberEats choose UAE as a stepping stone to test the broader market of GCC, Food delivery, in particular, choose UAE as their initial start where they set up initial operations, test the market and later expand into other countries like Saudi Arabia, Turkey, Bahrain, Oman, Egypt etc.

As this space is fast becoming saturated, competition is intensifying, More recently, Careem which bought over RoundMenu a restaurant listing platform for an undisclosed amount to test its food delivery service Careem now. With RoundMenu presence in 18 cities across 9 Arab countries combined with Careem’s huge network of 14 countries across Arab world, its hard to know who will come out as a winner in last-mile in this hugely crowded market.

“Innovation is a key theme as foodtech players continue to evolve and differentiate themselves, whether be it ordering via Tweet or via a virtual assist, in some cases order with a smartwatch, a smart TV, from your car or just order with your eyes; food tech player embrace innovation to stay ahead of the curve and maintain their market-leading positions.

But the red on the foodtech bottom line is the final leg delivery on its last mile to its customer. Ask any category of foodtech player their biggest concerns is to turn that red into black. The sliding delivery fee is not able to sustain the delivery network of drivers and to reach a critical mass you need to increase the demand on the network and balance that with the supply of drivers.

I am betting my money on ride-hailing category, says Atif Rafiq, Founder of Qafila a first mile expert, who believes that food delivery has less to do with the actual food and more about logistics and supply chain ecosystem. This naturally gives an edge to ‘superapp’ aspirants like Uber, Careem, & Mirsool who started out as ride-hailing or errand run services but have since tapped on their logistics expertise to expand into food delivery, effectively edging out dedicated foodtech startups with only restaurant listings and delivery to offer.

As mentioned, food delivery is less about food and more about logistics, and these transportation networks own the logistics market. These incumbent saves a significant amount of costs because it utilizes existing network of drivers to do pickups and delivery with logistics concepts like batch ordering for customers in the same line of journey, utilizing dead runs for the drivers by leverage any vacant cars as delivery vehicles, using their tracking information to evaluate which are closest to a given pick-up point. Given the short distances from point to point, they lower their cost by paying minimal diversion to the driver to drop off another order. Hence reducing concerns for the consumer about long delivery runs and food spoilage which are minimal.

At the end they will be able to squeeze out other players through their last-mile delivery networks, whether by more efficient management or even eating the costs of driver/delivery subsidies — often times offset through their other business lines — to ensure market share.”